VOO Dividend

VOO Dividend – Purchasing stock on or after the ex-dividend date will prevent you from getting paid the dividend. Qualified dividends are paid by domestic or international corporations that trade on significant American stock exchanges or by corporations operating in nations with whom the United States has tax treaties. Companies, whether private or public, are able to choose whether to pay dividends on a monthly, quarterly, or annual basis Click Here. With over 130 dividend exchange-traded funds (ETFs) listed on Morningstar, it is critical that you know how to select the best one for your portfolio.

For instance, the yields of two dividend funds could be comparable. However, given that dividends have traditionally increased more quickly in the ETF, you might prefer it. Approximately 40% of interests are located in Europe, and the remaining 25% are centered in the Pacific. Data is not meant to be traded; it is just offered for informational purposes.

Reuters disclaims all liability for any mistakes or omissions in the content, as well as for actions based on such content. The Reuters Instrument Code set, often known as the RIC, is Reuters’s intellectual property that it created and maintains. Investors can use turnover as a stand-in for the trading fees paid by mutual fund managers who frequently change the allocations of their positions.

Invesco High Yield Equity Dividend Achievers ETF (PEY)

Dividend ETFs offer the possibility of financial appreciation in addition to income. These funds gain from both dividend payments and earnings growth by investing in dividend-paying firms. Investing in income through dividend ETFs can be a more convenient option than holding and managing your own collection of dividend stocks. Investing in overseas stocks that offer dividend yields higher than average can be made convenient using VYMI.

The fund owns more companies than any other on our list, with a portfolio of about 1,300 stocks, providing excellent diversification. It’s crucial to remember that investing in dividend ETFs carries some risk. Any dividend ETF on our list can be chosen with confidence to complete a diverse investment strategy. The others are from Denmark, Belgium, the Netherlands, Italy, Japan, and the United Kingdom.

About thirty percent of the fund is invested in the top ten holdings of FDVV, making it somewhat top-heavy. The biggest industries for FDVV are financial services and technology, which make up 16% and 20% of total assets, respectively. The small-cap, value-oriented, and core dividend-paying U.S. equities that make up the WisdomTree U.S. SmallCap Dividend Fund are distributed reasonably evenly.

S&P 500 ETF Vanguard’s (VOO) 53 Dividends From 2010-2024 (History)

Does Vanguard (VOO), an S&P 500 ETF, pay dividends? It has, indeed. You can discover the historical dividend dates and payouts in this page. Before delving further into the study, there is an intriguing estimate that you can find.

S&P 500 ETF Vanguard (VOO) paid a dividend of 1.543 per share on Mar 22, 2024. Assume, you had bought 1000$ worth of shares before one year on Mar 23, 2023.

The closing price during Mar 23, 2023 was 362.64. For 1000$ you would have purchased 2 number of shares.

On Mar 22, 2024 your payout can be calculated as shown below.

The payout for 2 shares = 2 shares x 1.543 dividend per share

= $3.09

In case you had bought shares three years earlier for $1000 on Dec 14, 2020 at 335.01, your payout can be computed as shown.

Number of shares = 2

The Payout = Number of shares x Dividend per share = $3.09

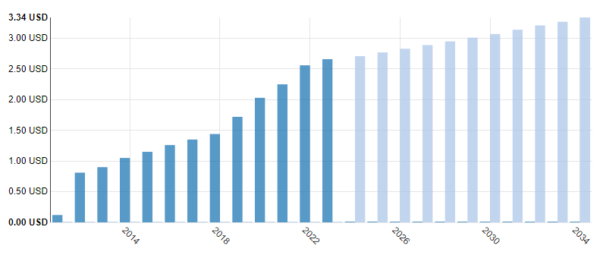

VOO Dividend Payouts Since Sep 24, 2010

Do you want to know how often VOO has been paying dividends? Here is your answer. Since Sep 24, 2010 there have been 53 dividend payouts.

S&P 500 ETF Vanguard (VOO) Dividend History

Let us now check the historical payments since Sep 24, 2010 till Mar 22, 2024.

The first section shows annual data. The second section lists the date wise payments.

VOO Annual Dividend History

Here is a list of annual dividend payments since Sep 24, 2010. (To calculate dividend for any year, we have summed all the dividends for that year.)

| Year | Dividend (Sum) |

|---|---|

| 2010 | 1.08 |

| 2011 | 2.37 |

| 2012 | 2.84 |

| 2013 | 3.11 |

| 2014 | 2.46 |

| 2015 | 3.93 |

| 2016 | 4.14 |

| 2017 | 4.37 |

| 2018 | 4.74 |

| 2019 | 5.57 |

| 2020 | 5.30 |

| 2021 | 4.10 |

| 2022 | 5.95 |

| 2023 | 6.36 |

| 2024 | 1.54 |

VOO Dividends And Dates

The below list shows the individual payouts and dates. (Note: For simplicity sake, we have limited the data to show only the recent 12 payouts at maximum.)

| Date | Dividend |

|---|---|

| Mar 22, 2024 | 1.543 |

| Dec 20, 2023 | 1.801 |

| Sep 28, 2023 | 1.493 |

| Jun 29, 2023 | 1.576 |

| Mar 24, 2023 | 1.487 |

| Dec 20, 2022 | 1.672 |

| Sep 28, 2022 | 1.469 |

| Jun 29, 2022 | 1.432 |

| Mar 24, 2022 | 1.374 |

| Dec 21, 2021 | 1.533 |

| Sep 29, 2021 | 1.308 |

| Mar 26, 2021 | 1.263 |

S&P 500 ETF Vanguard (VOO) Dividend Growth

The growth of dividends is a key metric in accessing companies that pay dividends. Below table shows the year on year growth rate of VOO dividends.

Note: A negative number in growth column suggests dividends have declined.

Conclusion: How To Assess A Stock Based On Dividends

While some stocks don’t pay dividends, others do. A lot of investors think that selecting dividend-paying stocks contributes to consistent income in addition to potential capital gains.

An even dividend schedule is an indicator of a stock’s sound financial standing. However, one should never lose sight of the possibility that fast-growing businesses—typically computer companies—may decide to use their profits to fund upcoming endeavors. They might therefore not produce dividends.

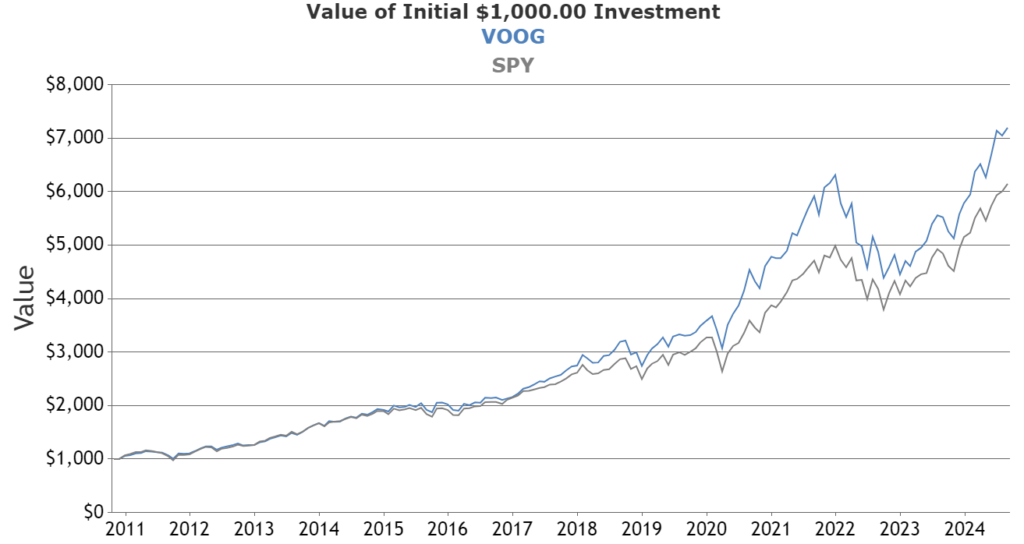

Vanguard S&P 500 ETF (VOO)

An exchange-traded fund (ETF) called the Vanguard S&P 500 ETF, or VOO, seeks to mimic the performance of the S&P 500 Index. The 500 biggest American corporations, representing a range of economic sectors, are included in the S&P 500 Index.

Investors who can endure a higher level of share volatility over a longer time horizon frequently choose for VOO. It offers exposure to the whole U.S. equities market, which has a track record of producing significant long-term returns. Nevertheless, there is a greater risk associated with possibly larger gains, and the short-term value of VOO is subject to large fluctuations.

Offering the possibility of substantial share appreciation is one of VOO’s main benefits. The value of the index’s (and so, VOO’s) shares tends to increase when the S&P 500 companies expand and earn more money. Over time, this growth may add to a greater overall portfolio worth, which will be especially helpful for people who have a long way to go until retirement.

It’s important to remember, though, that VOO doesn’t offer a sizable dividend income stream. While the majority of S&P 500 businesses do pay dividends, those payments are usually minimal in relation to the share value as a whole. Therefore, VOO might not be the greatest option if you need consistent income from your investments.

Read our More Articles

- Chris Tucker Net Worth, Biography, Early Life

- Melissa McCarthy Net Worth, Salary, Early Life, Career

- Tobey Maguire Net Worth, Height, Age, Biography

- HCMC Stock Price Prediction 2025, 2030, 2035, 2040, 2045 and 2050

- ALGO Price Prediction 2025, 2026, 2027, 2028, 2030, 2040-2050