Oracle Stock Dividend

Summary of Dividends

It is anticipated that Oracle Corp. Would pay its next dividend in two months after it goes ex. Oracle Stock Dividend 40c dividend for Oracle Corp. Went ex one month ago and was paid twenty days ago.

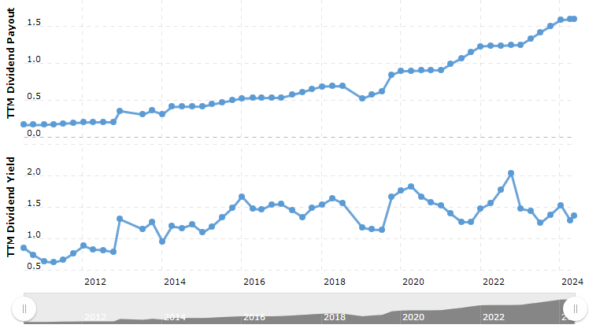

Except for specials, there are normally 4 dividends paid out annually, with a about 4.3 dividend cover. Historical dividend payout and yield for Oracle (ORCL) since 2011. The current TTM dividend payout for Oracle (ORCL) as of May 13, 2024 is $1.60. The current dividend yield for Oracle as of May 13, 2024 is 1.37%.

One of the biggest suppliers of enterprise-grade databases, middleware, and application software is Oracle Corporation. Over the past few years, Oracle has increased the scope of its cloud computing business. The business provides cloud services and solutions that are useful for creating and overseeing different cloud deployment models.

Based on freely available industry standards including HTML5, Java, and SQL, Oracle Cloud offers application, platform, and infrastructure services that can be accessed for a fee. The company offers Oracle Enterprise Manager, which is used to administer cloud systems. Oracle Database, Java, Oracle Fusion Middleware, and Oracle Engineered Systems are among the software and hardware products and services offered by Oracle.

The following are examples of Oracle Engineered Systems: ZFS Storage, SPARC SuperCluster, Oracle Database Appliance, Oracle Big Data Appliance, Exalogic Elastic Cloud, Exadata Database Machine, and Exalytics In-Memory Machine.

Gratitude Oracle Corp.’s Pattern of Dividends

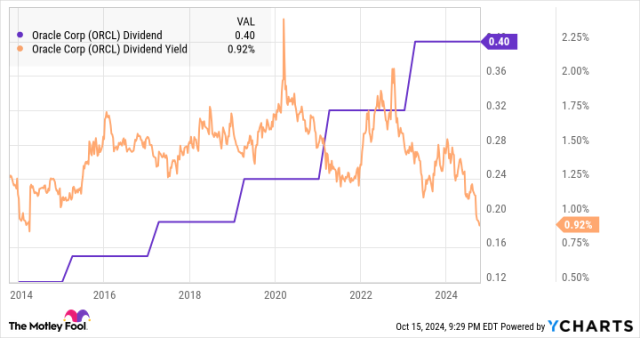

Oracle Corp. (NYSE:ORCL) just declared a $0.4 dividend per share, which will be paid on April 24, 2024. The dividend will not be paid on April 9, 2024. Investor attention is drawn to the company’s dividend history, yield, and growth rates in addition to this impending payment. Let’s examine Oracle Corp.’s dividend performance and evaluate its sustainability using data from GuruFocus.

An Overview of Oracle Corp.’s Dividend Record

Oracle Corp. has paid dividends on a quarterly basis with a track record of reliability since 2009. Since 2009, Oracle Corp. has raised its dividend annually, gaining the distinction of being a dividend achiever—a designation granted to businesses that have done so for at least 15 years. An yearly Dividends Per Share chart is provided below for tracking historical trends.

Breaking Down Oracle Corp’s Dividend Yield and Growth

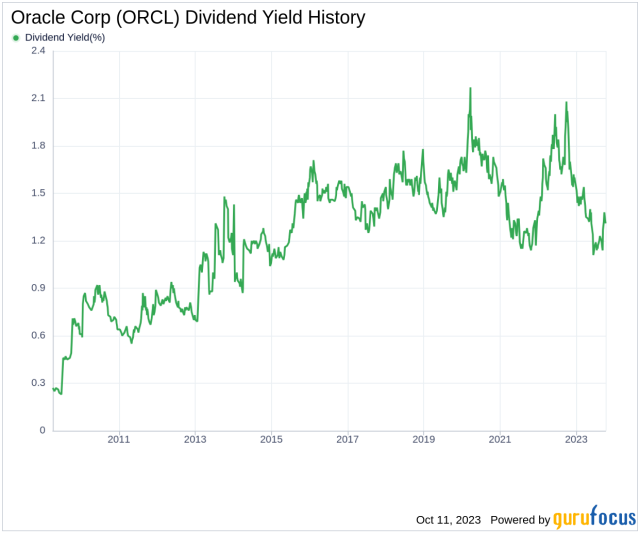

With a 12-month trailing dividend yield of 1.28% and a 12-month prospective dividend yield of 1.28% as of right now, Oracle Corp. is expected to continue paying dividends consistently in the following year. Oracle Corp.’s annual dividend growth rate grew to 13.30% each year over a five-year period from 12.30% during the previous three years. The yearly growth rate of dividends per share over the last ten years is a noteworthy 14.40%.

As of right now, Oracle Corp.’s five-year yield on cost is roughly 2.39%, based on the company’s dividend yield and five-year growth rate.

Oracle Corp. Dividend 2024 : Should Oracle Corp. be a part of your dividend portfolio?

Oracle Corp. is one of the most popular Technology Services company in the world with a market capitalisation of $322648.41Mn. Its share price is $116.67 as on 13 May,2024.

The dividend is a percentage of earnings paid out to shareholders. Last year, Oracle Corp. gave $1.6 for the full year, but should it be a part of your investments that give good dividends?

Key Highlights

- Technology Services stocks do not always pay a dividend but as Oracle Corp. pays dividends to reward its shareholders.

- In the quarter ending June 2024, Oracle Corp. has declared dividend of $0.4 – translating a dividend yield of 1.4%.

Let’s look at Oracle Corp.’s capacity to pay dividends and consider its valuation to determine its virtues as a dividend stock:

- Oracle Corp.’s dividend was $0.4 in the quarter ending June 2024.

Oracle Corp. Dividend related ratios:

- Last dividend date: 2024-03-11

- Current Dividend Yield: 1.37%

- Annual dollar dividend payment: $1.6

Oracle Dividend Yield at the end of each year (TTM)

| Date | Dividend Yield |

|---|---|

| 2024-05-10 | 1.37% |

| 2023-12-29 | 1.44% |

| 2022-12-30 | 1.57% |

| 2021-12-31 | 1.10% |

| 2020-12-31 | 1.48% |

| 2019-12-31 | 1.72% |

| 2018-12-31 | 1.68% |

| 2017-12-29 | 1.21% |

| 2016-12-30 | 1.17% |

| 2015-12-31 | 1.23% |

| 2014-12-31 | 0.80% |

| 2013-12-31 | 0.63% |

| 2012-12-31 | 1.26% |

| 2011-12-30 | 0.90% |

| 2010-12-31 | 0.64% |

| 2009-12-31 | 0.61% |

| 2008-12-31 | 0.00% |

| 2007-12-31 | 0.00% |

| 2006-12-29 | 0.00% |

| 2005-12-30 | 0.00% |

| 2004-12-31 | 0.00% |

| 2003-12-31 | 0.00% |

| 2002-12-31 | 0.00% |

| 2001-12-31 | 0.00% |

| 2000-12-29 | 0.00% |

| 1999-12-31 | 0.00% |

| 1998-12-31 | 0.00% |

| 1997-12-31 | 0.00% |

| 1996-12-31 | 0.00% |

| 1995-12-29 | 0.00% |

| 1994-12-30 | 0.00% |

| 1993-12-31 | 0.00% |

| 1992-12-31 | 0.00% |

| 1991-12-31 | 0.00% |

| 1990-12-31 | 0.00% |

| 1989-12-29 | 0.00% |

| 1988-12-30 | 0.00% |

| 1987-12-31 | 0.00% |

| 1986-12-31 | 0.00% |

Oracle Stock Dividend

| Ex-Dividend Date | Record Date | Payable Date | Amount Per Share |

|---|---|---|---|

| April 09, 2024 | April 10, 2024 | April 24, 2024 | $0.40 |

| January 10, 2024 | January 11, 2024 | January 25, 2024 | $0.40 |

| October 11, 2023 | October 12, 2023 | October 26, 2023 | $0.40 |

| July 11, 2023 | July 12, 2023 | July 26, 2023 | $0.40 |

| April 10, 2023 | April 11, 2023 | April 24, 2023 | $0.40 |

| January 09, 2023 | January 10, 2023 | January 24, 2023 | $0.32 |

| October 11, 2022 | October 12, 2022 | October 25, 2022 | $0.32 |

| July 11, 2022 | July 12, 2022 | July 26, 2022 | $0.32 |

| April 07, 2022 | April 08, 2022 | April 21, 2022 | $0.32 |

| January 06, 2022 | January 07, 2022 | January 19, 2022 | $0.32 |

| October 08, 2021 | October 12, 2021 | October 26, 2021 | $0.32 |

| July 14, 2021 | July 15, 2021 | July 29, 2021 | $0.32 |

| April 07, 2021 | April 08, 2021 | April 22, 2021 | $0.32 |

| January 06, 2021 | January 07, 2021 | January 21, 2021 | $0.24 |

| October 07, 2020 | October 08, 2020 | October 22, 2020 | $0.24 |

| July 14, 2020 | July 15, 2020 | July 28, 2020 | $0.24 |

| April 08, 2020 | April 09, 2020 | April 23, 2020 | $0.24 |

| January 08, 2020 | January 09, 2020 | January 23, 2020 | $0.24 |

| October 09, 2019 | October 10, 2019 | October 24, 2019 | $0.24 |

| July 16, 2019 | July 17, 2019 | July 31, 2019 | $0.24 |

| April 10, 2019 | April 11, 2019 | April 25, 2019 | $0.24 |

| January 15, 2019 | January 16, 2019 | January 30, 2019 | $0.19 |

| October 15, 2018 | October 16, 2018 | October 30, 2018 | $0.19 |

| July 16, 2018 | July 17, 2018 | July 31, 2018 | $0.19 |

| April 16, 2018 | April 17, 2018 | May 01, 2018 | $0.19 |

| January 09, 2018 | January 10, 2018 | January 24, 2018 | $0.19 |

| October 10, 2017 | October 11, 2017 | October 25, 2017 | $0.19 |

| July 17, 2017 | July 19, 2017 | August 02, 2017 | $0.19 |

| April 10, 2017 | April 12, 2017 | April 26, 2017 | $0.19 |

| January 03, 2017 | January 05, 2017 | January 26, 2017 | $0.15 |

| October 07, 2016 | October 12, 2016 | October 26, 2016 | $0.15 |

| July 01, 2016 | July 06, 2016 | July 27, 2016 | $0.15 |

| April 12, 2016 | April 14, 2016 | April 28, 2016 | $0.15 |

| January 04, 2016 | January 06, 2016 | January 27, 2016 | $0.15 |

| October 09, 2015 | October 14, 2015 | October 28, 2015 | $0.15 |

| July 06, 2015 | July 08, 2015 | July 29, 2015 | $0.15 |

| April 02, 2015 | April 07, 2015 | April 28, 2015 | $0.15 |

| January 05, 2015 | January 07, 2015 | January 28, 2015 | $0.12 |

| October 06, 2014 | October 08, 2014 | October 29, 2014 | $0.12 |

| July 07, 2014 | July 09, 2014 | July 30, 2014 | $0.12 |

| April 04, 2014 | April 08, 2014 | April 29, 2014 | $0.12 |

| January 03, 2014 | January 07, 2014 | January 28, 2014 | $0.12 |

| October 04, 2013 | October 08, 2013 | October 29, 2013 | $0.12 |

| July 10, 2013 | July 12, 2013 | August 02, 2013 | $0.12 |

| December 12, 2012 | December 14, 2012 | December 21, 2012 | $0.18 |

| October 10, 2012 | October 12, 2012 | November 02, 2012 | $0.06 |

| July 11, 2012 | July 13, 2012 | August 03, 2012 | $0.06 |

| April 09, 2012 | April 11, 2012 | May 02, 2012 | $0.06 |

| January 09, 2012 | January 11, 2012 | February 01, 2012 | $0.06 |

| October 07, 2011 | October 12, 2011 | November 02, 2011 | $0.06 |

| July 11, 2011 | July 13, 2011 | August 03, 2011 | $0.06 |

| April 11, 2011 | April 13, 2011 | May 04, 2011 | $0.06 |

| January 14, 2011 | January 19, 2011 | February 09, 2011 | $0.05 |

| October 04, 2010 | October 06, 2010 | November 03, 2010 | $0.05 |

| July 12, 2010 | July 14, 2010 | August 04, 2010 | $0.05 |

| April 12, 2010 | April 14, 2010 | May 05, 2010 | $0.05 |

| January 14, 2010 | January 19, 2010 | February 09, 2010 | $0.05 |

| October 09, 2009 | October 14, 2009 | November 04, 2009 | $0.05 |

| July 13, 2009 | July 15, 2009 | August 13, 2009 | $0.05 |

| April 06, 2009 | April 08, 2009 | May 08, 2009 | $0.05 |

The Sustainability Question: Payout Ratio and Profitability

The payout ratio of the corporation must be examined in order to determine whether the dividend is sustainable. The dividend payout ratio sheds light on the percentage of profits that the business gives out as dividends. A smaller ratio indicates that the business keeps a sizable portion of its earnings, guaranteeing cash flow for both unanticipated downturns and future growth. Oracle Corp.’s dividend payout ratio as of 2024-02-29 is 0.31.

As of 2024-02-29, Oracle Corp.’s profitability rank (which is 9 out of 10) indicates that company has high profitability prospects. Over the last ten years, the company has consistently generated positive net income, which further supports its strong profitability.

Growth Metrics: The Future Outlook

With a growth rank of 9 out of 10, Oracle Corp. appears to be on a high growth trajectory in comparison to its competitors. With an average annual growth rate of 15.00%, Oracle Corp.’s revenue per share and three-year revenue growth rate demonstrate a strong revenue model. This beats the performance of roughly 65.08% of its global competitors.

The company has outperformed roughly 38.85% of worldwide competitors, as evidenced by its 3-year EPS growth rate, which indicates an average yearly increase of roughly 2.90%. Moreover, the company’s 5-year EBITDA growth rate of 24.10% surpasses that of its global competitors by roughly 73.83%, signifying robust development in earnings before interest, taxes, depreciation, and amortization.

Concluding Thoughts on Oracle Corp’s Dividend Profile

Oracle Corp. has a robust dividend profile, as seen by its high profitability, good growth metrics, moderate payout ratio, and continuous dividend growth. Value investors looking for consistent and expanding revenue sources will find Oracle Corp to be a very attractive choice. The company’s strong financial condition and competitive market position support its capacity to sustain and increase its dividends. Oracle Corp.’s dividend policy is expected to remain a major draw for investors as the company innovates and adapts in a rapidly changing technology environment. A High Dividend Yield Screener is provided by GuruFocus Premium to help investors wishing to add high-dividend stocks to their portfolio find comparable prospects.

Oracle Stock Stock splits

| Effective Date | Split Amount |

|---|---|

| October 12, 2000 | 2 for 1 |

| January 18, 2000 | 2 for 1 |

| February 26, 1999 | 3 for 2 |

| August 15, 1997 | 3 for 2 |

| April 16, 1996 | 3 for 2 |

| February 22, 1995 | 3 for 2 |

| November 8, 1993 | 2 for 1 |

| June 16, 1989 | 2 for 1 |

| December 21, 1987 | 2 for 1 |

| March 9, 1987 | 2 for 1 |

Read our More Articles

- SoFi Stock Price Prediction 2025, 2030, 2035, 2040, 2045, 2050

- Axon Stock Price, Axon Enterprise Inc Stock Price Analysis

- IBRX Stock Price Live, Key Points and Company Profile

- Pi Coin Value in 2030, Piss Coin Price Prediction 2030