Medical Properties Trust Dividend Information

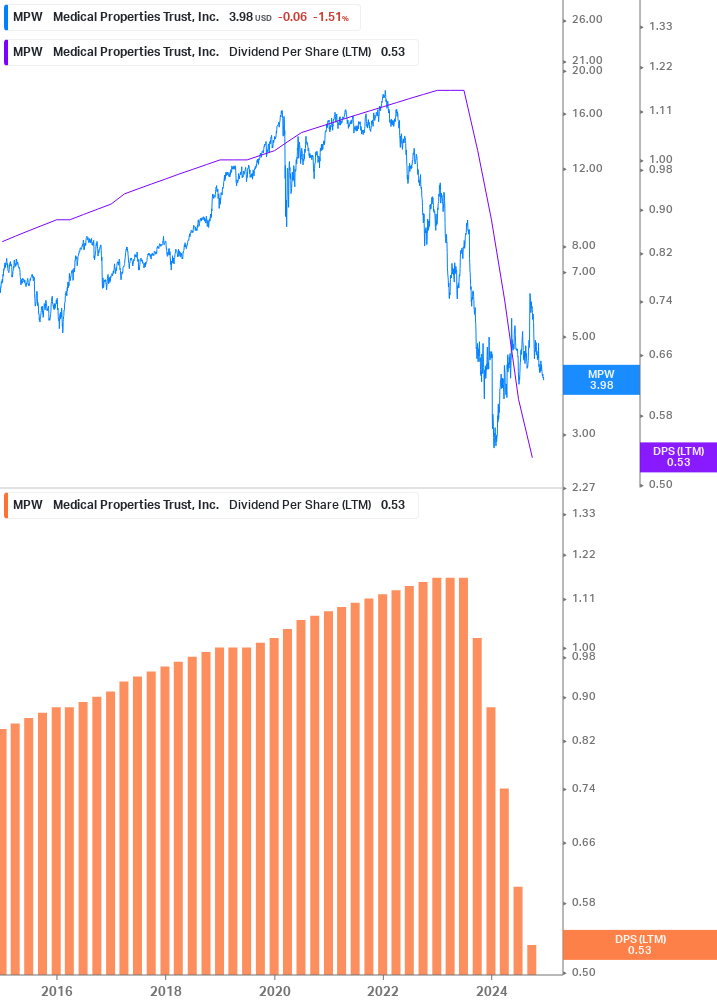

MPW Dividend History: Medical Properties Trust has an annual dividend of $0.60 per share, with a forward yield of 13.30%. The dividend is paid every three months and the last ex-dividend date was Dec 6, 2023.

MPW Dividend History and Payout History

| Ex Date | Record Date | Pay Date | Special | Amount | Note | % Change From Prev | % Change From Prev Year | Prior 12 Months Yield |

|---|---|---|---|---|---|---|---|---|

| 6-Dec-2023 | 7-Dec-2023 | 11-Jan-2024 | 0.1500 | Dividend income or Cash Dividend | -48.3% | 17.19% | ||

| 13-Sep-2023 | 14-Sep-2023 | 12-Oct-2023 | 0.1500 | Dividend income or Cash Dividend | -48.3% | -48.3% | 15.99% | |

| 14-Jun-2023 | 15-Jun-2023 | 13-Jul-2023 | 0.2900 | Dividend income or Cash Dividend | 13.15% | |||

| 15-Mar-2023 | 16-Mar-2023 | 13-Apr-2023 | 0.2900 | Dividend income or Cash Dividend | 14.82% | |||

| 7-Dec-2022 | 8-Dec-2022 | 12-Jan-2023 | 0.2900 | Dividend income or Cash Dividend | +3.6% | 10.43% | ||

| 14-Sep-2022 | 15-Sep-2022 | 13-Oct-2022 | 0.2900 | Dividend income or Cash Dividend | +3.6% | 9.28% | ||

| 15-Jun-2022 | 16-Jun-2022 | 14-Jul-2022 | 0.2900 | Dividend income or Cash Dividend | +3.6% | 8.98% | ||

| 16-Mar-2022 | 17-Mar-2022 | 14-Apr-2022 | 0.2900 | Dividend income or Cash Dividend; Increased | +3.6% | +3.6% | 6.76% | |

| 8-Dec-2021 | 9-Dec-2021 | 13-Jan-2022 | 0.2800 | Dividend income or Cash Dividend | +3.7% | 6.10% | ||

| 15-Sep-2021 | 16-Sep-2021 | 14-Oct-2021 | 0.2800 | Dividend income or Cash Dividend | +3.7% | 6.65% | ||

| 16-Jun-2021 | 17-Jun-2021 | 8-Jul-2021 | 0.2800 | Dividend income or Cash Dividend | +3.7% | 6.47% | ||

| 17-Mar-2021 | 18-Mar-2021 | 8-Apr-2021 | 0.2800 | Dividend income or Cash Dividend | +3.7% | +3.7% | 6.41% | |

| 9-Dec-2020 | 10-Dec-2020 | 7-Jan-2021 | 0.2700 | Dividend income or Cash Dividend | +3.9% | 6.65% | ||

| 9-Sep-2020 | 10-Sep-2020 | 8-Oct-2020 | 0.2700 | Dividend income or Cash Dividend | +3.9% | 7.64% | ||

| 17-Jun-2020 | 18-Jun-2020 | 16-Jul-2020 | 0.2700 | Dividend income or Cash Dividend | +8.0% | 6.91% | ||

| 11-Mar-2020 | 12-Mar-2020 | 9-Apr-2020 | 0.2700 | Dividend income or Cash Dividend | +3.9% | +8.0% | 6.40% | |

| 11-Dec-2019 | 12-Dec-2019 | 9-Jan-2020 | 0.2600 | +4.0% | 6.43% | |||

| 11-Sep-2019 | 12-Sep-2019 | 10-Oct-2019 | 0.2600 | Increased | +4.0% | +4.0% | 7.34% | |

| 12-Jun-2019 | 13-Jun-2019 | 11-Jul-2019 | 0.2500 | 7.72% | ||||

| 13-Mar-2019 | 14-Mar-2019 | 11-Apr-2019 | 0.2500 | 7.73% | ||||

| 12-Dec-2018 | 13-Dec-2018 | 10-Jan-2019 | 0.2500 | +4.2% | 8.40% | |||

| 12-Sep-2018 | 13-Sep-2018 | 11-Oct-2018 | 0.2500 | +4.2% | 9.51% | |||

| 13-Jun-2018 | 14-Jun-2018 | 12-Jul-2018 | 0.2500 | +4.2% | 10.27% | |||

| 14-Mar-2018 | 15-Mar-2018 | 12-Apr-2018 | 0.2500 | Increased | +4.2% | +4.2% | 11.04% | |

| 6-Dec-2017 | 7-Dec-2017 | 11-Jan-2018 | 0.2400 | +4.4% | 10.64% | |||

| 13-Sep-2017 | 14-Sep-2017 | 12-Oct-2017 | 0.2400 | +4.4% | 11.09% | |||

| 13-Jun-2017 | 15-Jun-2017 | 14-Jul-2017 | 0.2400 | +4.4% | 10.97% | |||

| 14-Mar-2017 | 16-Mar-2017 | 13-Apr-2017 | 0.2400 | Increased | +4.4% | +9.1% | 12.41% | |

| 6-Dec-2016 | 8-Dec-2016 | 12-Jan-2017 | 0.2300 | +4.6% | 12.37% | |||

| 13-Sep-2016 | 15-Sep-2016 | 13-Oct-2016 | 0.2300 | +4.6% | 10.59% | |||

| 14-Jun-2016 | 16-Jun-2016 | 14-Jul-2016 | 0.2300 | Increased | +4.6% | +4.6% | 10.06% | |

| 15-Mar-2016 | 17-Mar-2016 | 14-Apr-2016 | 0.2200 | 12.21% | ||||

| 8-Dec-2015 | 10-Dec-2015 | 14-Jan-2016 | 0.2200 | +4.8% | 13.37% | |||

| 15-Sep-2015 | 17-Sep-2015 | 15-Oct-2015 | 0.2200 | +4.8% | 14.00% | |||

| 9-Jun-2015 | 11-Jun-2015 | 9-Jul-2015 | 0.2200 | +4.8% | 11.75% | |||

| 10-Mar-2015 | 12-Mar-2015 | 9-Apr-2015 | 0.2200 | +4.8% | +4.8% | 11.05% | ||

| 2-Dec-2014 | 4-Dec-2014 | 8-Jan-2015 | 0.2100 | 11.47% | ||||

| 16-Sep-2014 | 18-Sep-2014 | 15-Oct-2014 | 0.2100 | +5.0% | 12.38% | |||

| 10-Jun-2014 | 12-Jun-2014 | 10-Jul-2014 | 0.2100 | +5.0% | 11.85% | |||

| 12-Mar-2014 | 14-Mar-2014 | 11-Apr-2014 | 0.2100 | +5.0% | 12.50% | |||

| 29-Nov-2013 | 3-Dec-2013 | 7-Jan-2014 | 0.2100 | +5.0% | 12.09% | |||

| 10-Sep-2013 | 12-Sep-2013 | 10-Oct-2013 | 0.2000 | 13.43% | ||||

| 11-Jun-2013 | 13-Jun-2013 | 11-Jul-2013 | 0.2000 | 11.02% | ||||

| 12-Mar-2013 | 14-Mar-2013 | 11-Apr-2013 | 0.2000 | 11.11% | ||||

| 20-Nov-2012 | 23-Nov-2012 | 5-Jan-2013 | 0.2000 | 18.40% | ||||

| 11-Sep-2012 | 13-Sep-2012 | 11-Oct-2012 | 0.2000 | 16.34% | ||||

| 12-Jun-2012 | 14-Jun-2012 | 12-Jul-2012 | 0.2000 | 19.83% | ||||

| 13-Mar-2012 | 15-Mar-2012 | 12-Apr-2012 | 0.2000 | 18.95% | ||||

| 6-Dec-2011 | 8-Dec-2011 | 5-Jan-2012 | 0.2000 | 19.07% | ||||

| 13-Sep-2011 | 15-Sep-2011 | 13-Oct-2011 | 0.2000 | 18.43% | ||||

| 14-Jun-2011 | 16-Jun-2011 | 14-Jul-2011 | 0.2000 | 16.71% | ||||

| 15-Mar-2011 | 17-Mar-2011 | 31-Mar-2011 | 0.2000 | 17.11% | ||||

| 7-Dec-2010 | 9-Dec-2010 | 6-Jan-2011 | 0.2000 | 23.87% | ||||

| 10-Sep-2010 | 14-Sep-2010 | 14-Oct-2010 | 0.2000 | 19.62% | ||||

| 15-Jun-2010 | 17-Jun-2010 | 15-Jul-2010 | 0.2000 | 21.16% | ||||

| 16-Mar-2010 | 18-Mar-2010 | 14-Apr-2010 | 0.2000 | 19.20% | ||||

| 15-Dec-2009 | 17-Dec-2009 | 14-Jan-2010 | 0.2000 | 20.78% | ||||

| 15-Sep-2009 | 17-Sep-2009 | 15-Oct-2009 | 0.2000 | -25.9% | 27.96% | |||

| 9-Jun-2009 | 11-Jun-2009 | 14-Jul-2009 | 0.2000 | -25.9% | 36.10% | |||

| 17-Mar-2009 | 19-Mar-2009 | 9-Apr-2009 | 0.2000 | -25.9% | 67.90% | |||

| 19-Dec-2008 | 23-Dec-2008 | 22-Jan-2009 | 0.2000 | -25.9% | 47.38% | |||

| 16-Sep-2008 | 18-Sep-2008 | 16-Oct-2008 | 0.2700 | 32.41% | ||||

| 11-Jun-2008 | 13-Jun-2008 | 11-Jul-2008 | 0.2700 | 28.45% | ||||

| 11-Mar-2008 | 13-Mar-2008 | 11-Apr-2008 | 0.2700 | 38.00% | ||||

| 11-Dec-2007 | 13-Dec-2007 | 11-Jan-2008 | 0.2700 | 30.26% | ||||

| 12-Sep-2007 | 14-Sep-2007 | 19-Oct-2007 | 0.2700 | +3.9% | 27.81% | |||

| 12-Jun-2007 | 14-Jun-2007 | 12-Jul-2007 | 0.2700 | +8.0% | 27.32% | |||

| 27-Mar-2007 | 29-Mar-2007 | 12-Apr-2007 | 0.2700 | 25.07% | ||||

| 12-Dec-2006 | 14-Dec-2006 | 11-Jan-2007 | 0.2700 | +3.9% | +50.0% | 23.91% | ||

| 12-Sep-2006 | 14-Sep-2006 | 12-Oct-2006 | 0.2600 | +4.0% | +52.9% | 25.37% | ||

| 13-Jun-2006 | 15-Jun-2006 | 13-Jul-2006 | 0.2500 | +19.1% | +56.3% | 25.35% | ||

| 13-Mar-2006 | 15-Mar-2006 | 12-Apr-2006 | 0.2100 | +16.7% | +90.9% | 27.25% | ||

| 13-Dec-2005 | 15-Dec-2005 | 19-Jan-2006 | 0.1800 | +5.9% | +63.6% | 26.71% | ||

| 13-Sep-2005 | 15-Sep-2005 | 29-Sep-2005 | 0.1700 | +6.3% | +70.0% | 21.51% | ||

| 16-Jun-2005 | 20-Jun-2005 | 14-Jul-2005 | 0.1600 | +45.5% | ||||

| 14-Mar-2005 | 16-Mar-2005 | 15-Apr-2005 | 0.1100 | |||||

| 14-Dec-2004 | 16-Dec-2004 | 11-Jan-2005 | 0.1100 | +10.0% | ||||

| 14-Sep-2004 | 16-Sep-2004 | 11-Oct-2004 | 0.1000 |

MPW Dividend Information

Medical Properties Trust’s next ex-dividend date is projected to be between 13-Mar – 15-Mar. The next dividend for MPW is projected to be 0.15.

About MPW’s dividend:

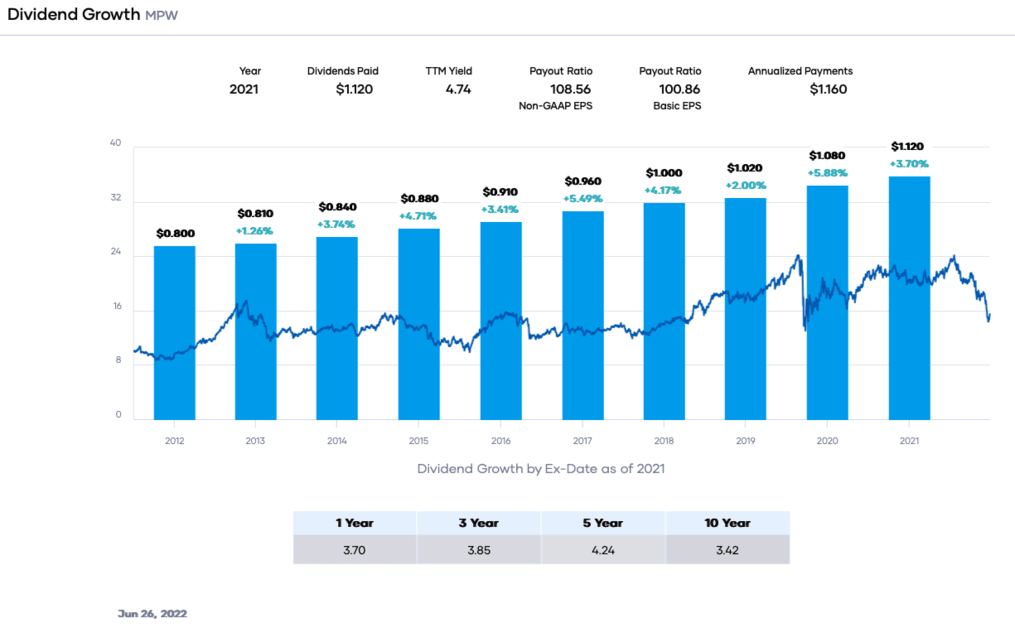

- Number of times Medical Properties Trust has decreased the dividend in the last 3 years: 1

- The number of times stock has increased the dividend in the last 3 years: 2

- The trailing 12 month dividend yield for MPW is: 19.5%

Dividend Yield and Dividend History Highlights

- In terms of history, this is the 22nd quarter in a row dividends for MPW have increased.

- As for stocks whose price is uncorrelated with MPW’s price and thus may be suitable peers for a diversified dividend portfolio, check out the following: BJRI, FDS, BRG, DIN and AMTD.

MPW Dividend Summary

The next Medical Properties Trust Inc dividend is expected to go ex in 6 days and to be paid in 1 month.

The previous Medical Properties Trust Inc dividend was 15c and it went ex 3 months ago and it was paid 2 months ago. Medical Properties Trust (MPW) announced on November 9, 2023 that shareholders of record as of December 6, 2023 would receive a dividend of $0.15 per share on January 11, 2024.

MPW currently pays investors $0.60 per share, or 13.54%, on an annual basis. The company increased its dividend 4 times in the past 5 years, and its payout has declined -3.85% over the same time period. MPW’s payout ratio currently sits at 38% of earnings. There are typically 4 dividends per year (excluding specials), and the dividend cover is approximately 1.0.

MPW Price Forecast Based on Dividend Discount Model

| Current Price | DDM Fair Value Target: | Forecasted Gain: |

| $4.51 | $71.44 | 232.41% |

The Dividend Discount Model (DDM) is a valuation model that attempts to determine a fair share price for a stock, based on the dividend it provides in comparison to several company-specific metrics indicative of the riskiness of the stock and the financial health of the company. As for MPW, the DDM model generated by StockNews estimates a return of positive 232.41% in comparison to its current price. Some interesting points we thought investors may wish to consider regarding the dividend discount model forecast for Medical Properties Trust Inc are:

- Compared to other US stocks that pay a dividend, Medical Properties Trust Inc’s dividend yield of 5.4% is in the top 11.57%.

- In comparison to other stocks in the small-sized revenue class, where its estimated gain based on our dividend discount model price relative to its current share price is greater than 81.69% of companies in the same revenue class.

- In terms of who is growing the amount of dividends they return to shareholders, Medical Properties Trust Inc has been increasing its dividends at a faster rate than 88.84% of US-listed dividend-issuing stocks we observed.

MPW Dividend Data

Medical Properties Trust, Inc.’s (MPW) dividend yield is 13.54%, which means that for every $100 invested in the company’s stock, investors would receive $13.54 in dividends per year.

Medical Properties Trust, Inc.’s payout ratio is NaN% which means that NaN% of the company’s earnings are paid out as dividends. A low payout ratio may indicate that the company has a strong financial position and can invest in growth opportunities, while a high payout ratio may indicate that the company is returning most of its earnings to shareholders. MPW’s annual dividend is $0.60 per share. This is the total amount of dividends paid out to shareholders in a year.

Medical Properties Trust, Inc.’s (MPW) ex-dividend date is , which means that buyers purchasing shares on or after that date will not be eligible to receive the next dividend payment.

Medical Properties Trust, Inc. (MPW) pays dividends on a quarterly basis. Medical Properties Trust, Inc. (MPW) has increased its dividends for 1 year. This is a positive sign of the company’s financial stability and its ability to pay consistent dividends in the future.

Dividend History and Growth

Medical Properties Trust, Inc. (MPW) dividend payments per share are an average of -24.14% over the past 12 months, -6.60% over the past 36 months, -2.52% over the past 60 months, and 0.83% over the past 120 months.

It is important to note that MPW’s dividend history and growth can be affected by many factors, such as profitability, cash flow, and financial stability, as well as its growth prospects and dividend payout policies. Add MPW to your watchlist to be aware of any updates.

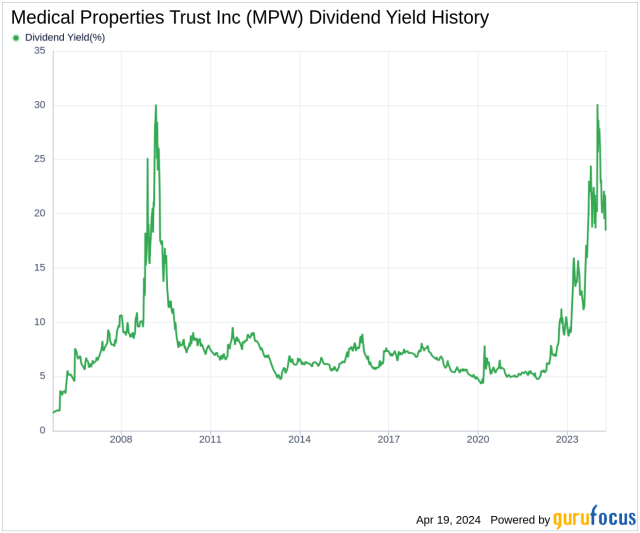

Dividend Yield

MPW dividend yield graph is a visual representation of Medical Properties Trust, Inc.’s dividend yield over the last 12 months. This is useful for investors to understand MPW’s historical dividend yield and to identify any trends or patterns in the company’s dividend payments over time.

Shareholder Yield

Shareholder yield is a metric that measures the total return to shareholders through dividends, buybacks, and debt paydown. It is a ratio that compares the cash returned to shareholders over a period of time to the market capitalization of the company.

Medical Properties Trust, Inc. (MPW) shareholder yield graph below includes indicators for dividends, buybacks, and debt paydown, which allows investors to see how each component contributes to the overall shareholder yield.

It’s important to note that shareholder yield is just one metric among many that investors may use to evaluate a company’s financial health and its potential for future growth. It should be considered in conjunction with other financial metrics such as earnings, revenue, and debt levels to get a comprehensive understanding of a company’s financial position.

Dividend Safety

Dividend safety refers to the ability of a company to continue paying its dividends to shareholders without interruption or reduction. A company with a high level of dividend safety is generally considered to have a strong financial position, with a consistent history of paying dividends and a low risk of default.

Some specific indicators often used to assess Medical Properties Trust, Inc. (MPW) dividend safety include

- Dividend payment history: MPW has a history of paying dividends and has consistently increased its dividend payout for 1 year.

- Dividend payout ratio: Not available

It is worth noting that Dividend safety can change over time, and a company that was considered to have a high level of dividend safety in the past may no longer be considered safe today. Therefore, it is important to regularly monitor a company’s financial performance and dividend payment history.

Comparing Medical Properties Trust, Inc. to Other Stock

The percentile ranks table is a way to compare Medical Properties Trust, Inc. (MPW) dividend yield relative to its sector, country, and the world.

- Dividend yield: MPW’s latest value of 13.54% is the percentage of the current stock price that is paid out as dividends to shareholders. The relative to the sector, country, and world values (0.92, 0.97, and 0.98 respectively) indicate Medical Properties Trust, Inc.’s dividend yield compared to others in its sector, country, and world. For example, a value of 0.97 relative to country means that Medical Properties Trust, Inc.’s dividend yield is higher than 97% of companies in its country.

This table allows investors to quickly compare a company’s dividend metrics to its peers in the sector, country, and the world, and evaluate its relative stability and growth potential.

MPW Growth History

Medical Properties Trust Stock Forecast

Stock Price Forecast

The 10 analysts with 12-month price forecasts for MPW stock have an average target of 5.95, with a low estimate of 2.00 and a high estimate of 10. The average target predicts an increase of 31.93% from the current stock price of 4.51.

Analyst Ratings

The average analyst rating for MPW stock from 12 stock analysts is “Hold”. This means that analysts believe this stock is likely to perform similarly to the overall market.

MPW Next Dividend

Dividend FAQ

Does Medical Properties Trust, Inc. pay dividends?

Medical Properties Trust, Inc. (MPW) pays dividends to its shareholders.

How much is Medical Properties Trust, Inc.’s dividend?

Medical Properties Trust, Inc.’s (MPW) quarterly dividend per share was $0.15 as of January 11, 2024.

When is Medical Properties Trust, Inc.’s ex-dividend date?

Medical Properties Trust, Inc.’s latest ex-dividend date was on December 6, 2023. The MPW stock shareholders received the last dividend payment of $0.15 per share on January 11, 2024.

When is Medical Properties Trust, Inc.’s next dividend payment date?

Medical Properties Trust, Inc.’s next dividend payment has not been announced at this time.

How often does MPW pay dividends?

Medical Properties Trust (MPW) pays dividends quarterly. This means they distribute dividends to their shareholders four times a year. The most recent dividend payment was $0.15 per share on January 11, 2024. The next dividend payment date has not been officially announced yet, but it is typically around three months after the previous payment.

Is MPW stock a good buy?

Whether or not Medical Properties Trust (MPW) stock is a good buy for you depends on your individual investment goals and risk tolerance. Here’s a summary of some factors to consider:

Potential benefits:

- High dividend yield: MPW currently offers a 15.6% dividend yield, which is significantly higher than the average stock and can be attractive to income-seeking investors.

- Potential for price appreciation: Some analysts believe the stock is undervalued and has potential for growth, though the average analyst rating is currently “hold”.

Potential risks:

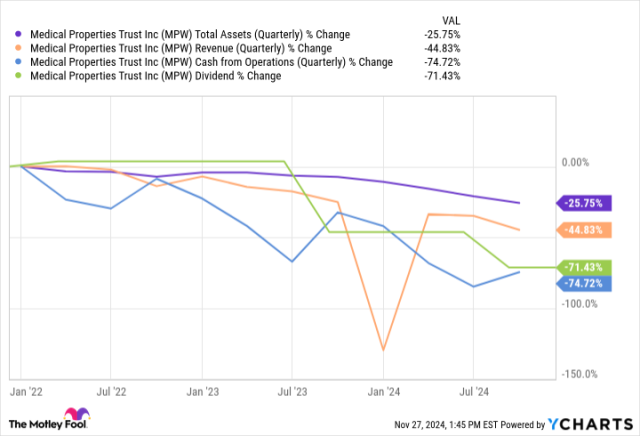

- Tenant challenges: MPW has faced challenges with some of its tenants, including Steward Health, which has raised concerns about the company’s future cash flow.

- Stock price volatility: MPW’s stock price has been volatile in recent months, and it is important to be aware of the potential for further price declines.

- Uncertainty about future dividend payments: While MPW has historically maintained its dividend, there is no guarantee that they will continue to do so in the future, especially if their financial performance weakens.

What is MPW average dividend yield?

MPW’s average dividend yield can be calculated in a few ways, depending on the time frame you’re interested in:

- Trailing twelve months (TTM): This is the most commonly cited average and is based on the annualized dividend payments over the past year. As of March 4, 2024, MPW’s TTM dividend yield is 20.05%.

- Past 5 years: Looking at the past 5 years, MPW’s average dividend yield is around 11.5%. This shows that the current yield is significantly higher than the historical average.

- Since inception: MPW has been paying dividends since its IPO in 2007. The average dividend yield since then is around 7.5%.

It’s important to note that past performance is not necessarily indicative of future results, and MPW’s dividend yield could fluctuate in the future.

What does MPW invest in?

Medical Properties Trust (MPW) invests in net-leased healthcare facilities through acquisitions and development. These facilities encompass a diverse range within the healthcare sector, including:

- Rehabilitation hospitals: These facilities help patients recover from illnesses, injuries, or surgeries.

- Long-term acute care hospitals (LTACHs): These hospitals provide specialized care for patients requiring prolonged treatment beyond what a typical hospital stay can offer.

- Ambulatory surgery centers (ASCs): These facilities are designed for outpatient surgical procedures that don’t require an overnight stay.

- Hospitals for women and children: These hospitals cater specifically to the needs of women and children, providing a range of medical services.

- Regional and community hospitals: These hospitals serve larger communities and offer a broad spectrum of healthcare services.

- Medical office buildings: These buildings house various medical practitioners and related healthcare services.

- Other single-discipline facilities: This category includes specialized healthcare facilities like imaging centers or dialysis centers.

By focusing on net-leased properties, MPW earns rent from the healthcare tenants operating the facilities. These leases typically involve the tenant covering most, if not all, of the operating expenses, providing a relatively stable income stream for MPW.

Is Medical Properties Trust dividend safe?

Whether Medical Properties Trust’s (MPW) dividend is safe is a complex question with no definitive answer. Here’s a breakdown of the factors to consider:

Arguments for the safety of the dividend:

- Reduced dividend: MPW cut its dividend from $0.29 per share to $0.15 per share in 2023. This helped bring the dividend payout ratio (percentage of earnings paid out as dividends) down to a more sustainable level.

- Funds from operations (FFO) coverage: As of Q3 2023, MPW’s FFO comfortably covered their dividend, indicating they have enough cash flow to support the current payout.

Arguments against the safety of the dividend:

- High debt: MPW has a relatively high debt-to-equity ratio, which could make them vulnerable to rising interest rates and economic downturns. This could impact their cash flow and ability to maintain dividend payments.

- Tenant challenges: MPW has faced challenges with some of its tenants, including Steward Health. These issues could affect their future rental income and cash flow.

- Uncertainties in the healthcare sector: The broader healthcare sector faces uncertainties, including regulatory changes and potential cost pressures. This could indirectly impact MPW’s business.

Overall, the safety of MPW’s dividend is uncertain. While the recent dividend reduction and FFO coverage offer some reassurance, the high debt and tenant challenges raise significant concerns.

It’s crucial to conduct your own research and consider your risk tolerance before investing in MPW for its dividend. Consulting with a financial advisor is also recommended for personalized investment guidance.

Will Medical Properties Trust cut its dividend?

Predicting whether Medical Properties Trust (MPW) will cut its dividend in the future is impossible. However, I can share some information and analysis that might help you form your own opinion:

Factors suggesting a potential dividend cut:

- History of dividend cuts: MPW has a history of cutting its dividend in the past, most recently in August 2023 by nearly 50%. This suggests they are willing to adjust the dividend if necessary.

- High debt: MPW has a relatively high debt-to-equity ratio, which could become more burdensome if interest rates rise or their cash flow weakens. This could pressure them to cut the dividend to conserve cash for debt payments.

- Tenant challenges: MPW faces challenges with some tenants, including Steward Health, which has raised concerns about the company’s future cash flow. If tenant issues worsen, it could further strain their ability to maintain the dividend.

Factors suggesting a potential continuation of the dividend:

- Recent dividend reduction: The 2023 dividend cut may have been a preemptive measure to bring the payout ratio to a more sustainable level. This could help them avoid further cuts in the near future.

- FFO coverage: As of Q3 2023, MPW’s FFO (funds from operations) comfortably covered the current dividend. This indicates they have enough cash flow to support the current payout, at least in the near term.

- Focus on improving financial health: MPW has been taking steps to improve its financial health, including selling assets and reducing expenses. This could help them maintain the dividend over time.

Overall, the future of MPW’s dividend is uncertain. While the recent reduction and FFO coverage offer some hope, the high debt and tenant challenges pose significant risks. It’s crucial to conduct your own research and consider your risk tolerance before making investment decisions based on dividends. Consulting with a financial advisor is recommended for personalized investment guidance.

What is the future of MPW stock?

Predicting the future of any stock is inherently uncertain, and Medical Properties Trust (MPW) is no exception. However, I can share some insights based on available information:

Potential future growth factors:

- Recovery of healthcare industry: If the broader healthcare industry experiences a period of growth, it could benefit MPW as a real estate investment trust (REIT) heavily invested in healthcare facilities.

- Increased demand for healthcare services: As the global population ages, the demand for healthcare services is expected to increase, potentially leading to higher occupancy rates and rental income for MPW’s properties.

- Continued focus on cost-cutting: If MPW successfully manages to reduce expenses and improve its financial health, it could free up resources for potential future dividend increases or stock price appreciation.

Potential future challenges:

- Economic downturns: Economic downturns can negatively impact the healthcare sector, potentially leading to lower occupancy rates and rental income for MPW.

- Rising interest rates: High interest rates could increase MPW’s debt burden and impact their cash flow, potentially affecting their ability to maintain dividend payments.

- Tenant defaults or lease expirations: If tenants default on their leases or fail to renew expiring leases, it could negatively impact MPW’s rental income and cash flow.

Analyst opinions:

- Average analyst rating: As of March 7, 2024, the average analyst rating for MPW is “hold”, indicating a neutral outlook.

- Price targets: Analyst price targets for MPW range from $2.00 to $7.00, with an average target of $4.57. This suggests some analysts believe there is potential for both upside and downside movement in the stock price.

Overall, the future of MPW stock is uncertain. It faces both potential growth opportunities and significant challenges. It’s crucial to conduct your own research, consider your risk tolerance, and potentially consult with a financial advisor before making any investment decisions based on this information.

Who owns MPW stock?

MPW stock is owned by a mix of institutional and individual investors. Here’s a breakdown of the ownership structure:

- Institutional Investors: These are large organizations that invest on behalf of others, such as mutual funds, pension funds, and hedge funds. As of December 31, 2023, institutional investors owned approximately 66.02% of MPW’s outstanding shares.

- Public Companies and Individual Investors: This category includes individual investors and smaller companies that own shares of MPW. As of December 31, 2023, public companies and individual investors owned approximately 32.19% of MPW’s outstanding shares.

- Insiders: These are individuals who have significant ownership stakes in the company, such as company executives and board members. As of December 31, 2023, insiders owned approximately 1.79% of MPW’s outstanding shares.

While specific details about individual investors are not publicly available, some of the largest institutional shareholders of MPW include:

- The Vanguard Group

- BlackRock Inc.

- State Street Corp

- Cohen & Steers, Inc.

- Geode Capital Management, LLC

It’s important to note that this information is subject to change and may not be entirely up-to-date. You can find more detailed information about MPW’s ownership structure in the company’s most recent annual report or proxy statement.

Is Medical Properties Trust a hold or sell?

Based on the information I have gathered, analysts give Medical Properties Trust (MPW) a neutral “hold” recommendation on average. Here’s a summary of the key points to consider:

Arguments for holding MPW:

- Potential for future growth: The healthcare industry, where MPW invests, could experience growth in the future due to factors like an aging population and rising demand for services.

- High dividend yield: MPW offers a 15.6% dividend yield, which is significantly higher than the average stock and can be attractive to income-seeking investors.

- Recent cost-cutting efforts: MPW is taking steps to improve its financial health by reducing expenses, which could benefit the stock in the long run.

Arguments for selling MPW:

- Uncertainty surrounding the future of the dividend: While the recent dividend reduction helped improve sustainability, the high debt and tenant challenges raise concerns about future payouts.

- High debt levels: MPW’s high debt-to-equity ratio makes them vulnerable to rising interest rates and economic downturns, potentially impacting their cash flow and stock price.

- Tenant challenges: Issues with some tenants, like Steward Health, raise concerns about future rental income and cash flow.

Overall, the decision of whether to hold or sell MPW depends on your individual investment goals and risk tolerance. Carefully consider the potential risks and rewards before making any decisions.