Jepi Dividend History

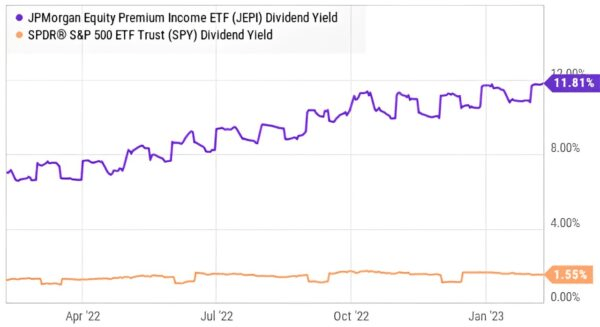

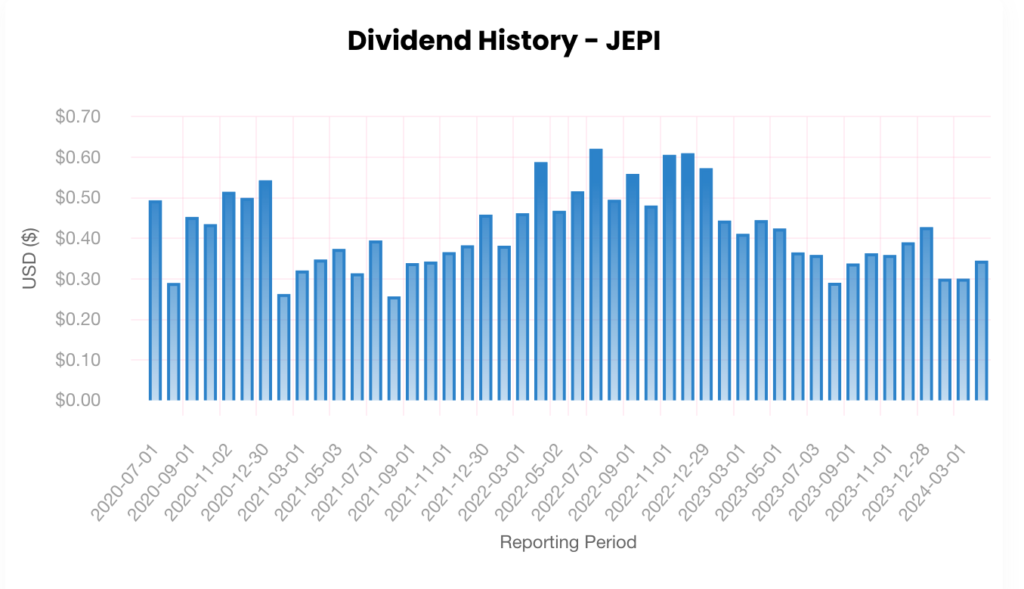

Jepi Dividend History – The last dividend JPMorgan Equity Premium Income ETF (JEPI) as of March 5, 2024 is 0.30 USD. The forward dividend yield for JEPI as of March 5, 2024 is 6.33%. The average dividend growth rate for stock JPMorgan Equity Premium Income ETF (JEPI) for the past three years is 0.33%.

Dividend history for stock JEPI (JPMorgan Equity Premium Income ETF) including historic stock price, dividend growth rate predictions based on history, payout ratio history and split, spin-off and special dividends.

JEPI Dividend History

- EX-DIVIDEND DATE – 03/01/2024

- DIVIDEND YIELD – 6.35%

- ANNUAL DIVIDEND – $3.6108

- P/E RATIO – N/A

JP Morgan Last 4 Year Equity Premium Income ETF Dividends

| Ex-dividend date | Payable date | Dividend amount (change) | Adjusted Price | Close Price |

|---|---|---|---|---|

| 2024-02-01 | 2024-02-06 | 0.3006 USD (-29.73%) | 56.25 USD | 56.25 USD |

| 2023-12-28 | 2024-01-03 | 0.4278 USD (9.64%) | 54.98 USD | 54.98 USD |

| 2023-12-01 | 2023-12-06 | 0.3902 USD (8.72%) | 54.55 USD | 54.55 USD |

| 2023-11-01 | 2023-11-06 | 0.3589 USD (-1.21%) | 53.80 USD | 53.80 USD |

| 2023-10-02 | 2023-10-05 | 0.3633 USD (7.42%) | 53.05 USD | 53.05 USD |

| 2023-09-01 | 2023-09-07 | 0.3382 USD (16.46%) | 53.56 USD | 53.56 USD |

| 2023-08-01 | 2023-08-04 | 0.2904 USD (-19.18%) | 55.37 USD | 55.37 USD |

| 2023-07-03 | 2023-07-07 | 0.3593 USD (-1.67%) | 55.32 USD | 55.32 USD |

| 2023-06-01 | 2023-06-06 | 0.3654 USD (-13.94%) | 53.92 USD | 53.92 USD |

| 2023-05-01 | 2023-05-04 | 0.4246 USD (-4.61%) | 54.02 USD | 54.02 USD |

| 2023-04-03 | 2023-04-06 | 0.4451 USD (8.24%) | 53.89 USD | 54.26 USD |

| 2023-03-01 | 2023-03-06 | 0.4112 USD (-7.37%) | 52.37 USD | 53.16 USD |

| 2023-02-01 | 2023-02-06 | 0.4439 USD (-22.52%) | 53.81 USD | 55.04 USD |

| 2022-12-29 | 2023-01-04 | 0.5729 USD (-6.14%) | 53.08 USD | 54.73 USD |

| 2022-12-01 | 2022-12-06 | 0.6104 USD (0.68%) | 53.86 USD | 56.12 USD |

| 2022-11-01 | 2022-11-04 | 0.6063 USD (26.10%) | 51.18 USD | 53.91 USD |

| 2022-10-03 | 2022-10-06 | 0.4808 USD (-13.97%) | 48.77 USD | 51.95 USD |

| 2022-09-01 | 2022-09-07 | 0.5589 USD (12.80%) | 51.21 USD | 55.07 USD |

| 2022-08-01 | 2022-08-04 | 0.4955 USD (-20.21%) | 52.22 USD | 56.73 USD |

| 2022-07-01 | 2022-07-07 | 0.6210 USD (20.26%) | 50.65 USD | 55.50 USD |

| 2022-06-01 | 2022-06-06 | 0.5164 USD (10.32%) | 51.69 USD | 57.28 USD |

| 2022-05-02 | 2022-05-05 | 0.4681 USD (-20.36%) | 51.77 USD | 57.88 USD |

| 2022-04-01 | 2022-04-06 | 0.5878 USD (27.15%) | 54.13 USD | 61.01 USD |

| 2022-03-01 | 2022-03-04 | 0.4623 USD (21.08%) | 51.66 USD | 58.79 USD |

| 2022-02-01 | 2022-02-04 | 0.3818 USD (-16.75%) | 53.01 USD | 60.79 USD |

| 2021-12-30 | 2022-01-04 | 0.4586 USD (19.93%) | 54.65 USD | 63.07 USD |

| 2021-12-01 | 2021-12-06 | 0.3824 USD (4.45%) | 51.33 USD | 59.67 USD |

| 2021-11-01 | 2021-11-04 | 0.3661 USD (6.61%) | 52.53 USD | 61.45 USD |

| 2021-10-01 | 2021-10-06 | 0.3434 USD (1.36%) | 50.77 USD | 59.74 USD |

| 2021-09-01 | 2021-09-07 | 0.3388 USD (31.73%) | 52.59 USD | 62.24 USD |

| 2021-08-02 | 2021-08-05 | 0.2572 USD (-34.95%) | 51.62 USD | 61.43 USD |

| 2021-07-01 | 2021-07-07 | 0.3954 USD (26.12%) | 50.58 USD | 60.45 USD |

| 2021-06-01 | 2021-06-04 | 0.3135 USD (-16.11%) | 49.30 USD | 59.30 USD |

| 2021-05-03 | 2021-05-06 | 0.3737 USD (7.29%) | 49.03 USD | 59.29 USD |

| 2021-04-01 | 2021-04-07 | 0.3483 USD (8.44%) | 47.57 USD | 57.89 USD |

| 2021-03-01 | 2021-03-04 | 0.3212 USD (22.32%) | 45.37 USD | 55.55 USD |

| 2021-02-01 | 2021-02-04 | 0.2626 USD (-51.62%) | 44.72 USD | 55.07 USD |

| 2020-12-30 | 2021-01-05 | 0.5428 USD (8.58%) | 44.73 USD | 55.35 USD |

| 2020-12-01 | 2020-12-04 | 0.4999 USD (-2.93%) | 44.11 USD | 55.12 USD |

| 2020-11-02 | 2020-11-05 | 0.5150 USD (18.45%) | 41.49 USD | 52.31 USD |

| 2020-10-01 | 2020-10-06 | 0.4348 USD (-4.10%) | 41.53 USD | 52.88 USD |

| 2020-09-01 | 2020-09-04 | 0.4534 USD (56.45%) | 41.65 USD | 53.48 USD |

| 2020-08-03 | 2020-08-06 | 0.2898 USD (-41.35%) | 41.00 USD | 53.09 USD |

| 2020-07-01 | 2020-07-07 | 0.4941 USD | 38.98 USD | 50.74 USD |

The JPMorgan Equity Premium Income ETF (JEPI) is an exchange-traded fund that mostly invests in large cap equity. The fund is an actively-managed fund that invests in large-cap US stocks and equity-linked notes (ELNs). It seeks to provide similar returns as the S&P 500 Index with lower volatility and monthly income. JEPI was launched on May 20, 2020 and is issued by JPMorgan Chase.

J.P. Morgan’s Equity Premium Income ETF (JEPI) Description

JEPI is an actively managed ETF popular with dividend investors and retirees looking to earn yields above total market ETFs such as VTI and popular dividend ETFs.

The fund aims to seek current dividend income while maintaining the prospects for price appreciation.

JEPI is a covered call ETF. The fund holds undervalued stocks in its benchmark index. Managers sell covered calls (a basic and low-risk option strategy) against the benchmark index to generate income for investors via equity-linked notes (ELNs).

Fund managers use the proceeds from selling covered calls to pay dividends to investors.

JPMorgan Equity Premium Income ETF seeks to deliver monthly distributable income and equity market exposure with less volatility.

EXPERTISE

- Portfolio managers with over 60 years of combined experience investing in equities and equity derivatives.

PORTFOLIO

- Defensive equity portfolio employs a time-tested, bottom-up fundamental research process with stock selection based on our proprietary risk-adjusted stock rankings.

- Disciplined options overlay implements written out-of-the-money S&P 500 Index call options to generate distributable monthly income.

RESULTS

- Provided an attractive 12-month rolling dividend yield of 8.50% and 30-day SEC yield of 7.04%.

- Yield ranked in the top one-third of the Derivative Income category.1

- Competitively priced vs. peers at 0.35%.

Definition of Divident

A dividend is a payment made by a corporation to its shareholders, typically in the form of cash or additional shares of stock, as a distribution of profits. It represents a portion of the company’s earnings that is distributed to its shareholders as a reward for investing in the company. Dividends are usually paid on a regular basis, such as quarterly or annually, and are often declared by the company’s board of directors. The amount of the dividend per share is determined by the company’s dividend policy and financial performance. Dividends are one way for investors to receive a return on their investment in addition to any potential capital appreciation of the stock.

History of Jepi Morgan

- Founding:

- J.P. Morgan traces its origins back to the 19th century, when Junius Spencer Morgan, known as J.S. Morgan, founded the banking firm J.S. Morgan & Co. In London in 1854.

- Expansion and Merger:

- In 1871, J.S. Morgan’s son, John Pierpont Morgan, established the banking firm J.P. Morgan & Co. in New York City. Under J.P. Morgan’s leadership, the firm expanded rapidly and became one of the most influential financial institutions in the United States.

- Throughout the late 19th and early 20th centuries, J.P. Morgan & Co. played a significant role in financing industrial giants such as General Electric and U.S. Steel, as well as providing funding for infrastructure projects such as railroads.

- Banking and Investment Activities:

- J.P. Morgan & Co. was involved in various banking and investment activities, including underwriting securities, providing loans, and managing assets for wealthy individuals and corporations.

- The firm also played a key role in organizing and financing mergers and acquisitions, earning J.P. Morgan the nickname “The Napoleon of Wall Street.”

- Banking Crisis and Regulation:

- In the early 20th century, J.P. Morgan & Co. played a central role in stabilizing financial markets during times of crisis, including the Panic of 1907, where J.P. Morgan personally intervened to prevent a banking collapse.

- The banking activities of J.P. Morgan & Co. and other major banks led to increased scrutiny and regulation, culminating in the passage of the Glass-Steagall Act in 1933, which separated commercial and investment banking activities.

- Later Years and Mergers:

- In 1935, after the death of J.P. Morgan, the firm was reorganized as Morgan Stanley.

- Over the years, various mergers and acquisitions reshaped the landscape of J.P. Morgan’s operations. In 2000, J.P. Morgan & Co. merged with Chase Manhattan Corporation to form JPMorgan Chase & Co., one of the largest and most influential banking institutions in the world.

- Modern J.P. Morgan:

- Today, J.P. Morgan Chase & Co. is a global financial services firm with operations spanning investment banking, asset management, commercial banking, and wealth management.

- J.P. Morgan Chase & Co. is headquartered in New York City and continues to be a leading player in the global financial industry, providing a wide range of services to clients around the world.

Frequently Asked Questions

Are dividends an expense?

Are reinvested dividends taxable?

Does JEPI stock pay dividends?

When does JEPI pay dividends?

How often does JEPI pay dividends?

How much does JEPI pay in dividends?

Read our More Articles:

- What Is a Stock Dividend? Complete Explanation!

- Pi Coin Value in 2030, Piss Coin Price Prediction 2030

- QYLD Stock Dividend History, Dates & Yield – Stock Analysis

- IBRX Stock Price Live, Key Points and Company Profile