Table of Contents

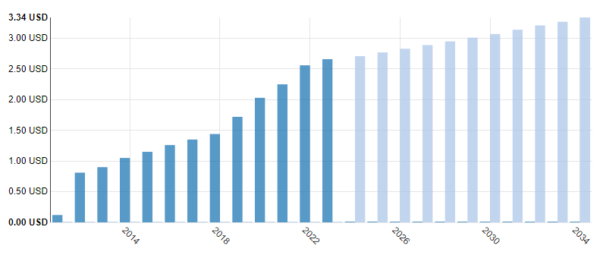

ToggleSchwab Dividend Yield History and Date ETF dividend growth rate

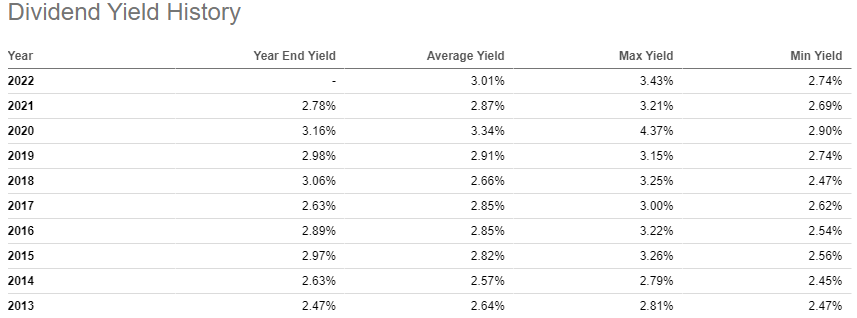

SCHD Dividend Yield History

Year | Year End Yield | Average Yield | Max Yield | Min Yield |

|---|---|---|---|---|

| 2024 | – | 3.45% | 3.53% | 3.37% |

| 2023 | 3.49% | 3.58% | 3.91% | 3.28% |

| 2022 | 3.39% | 3.15% | 3.73% | 2.74% |

| 2021 | 2.78% | 2.87% | 3.21% | 2.69% |

| 2020 | 3.16% | 3.34% | 4.37% | 2.90% |

| 2019 | 2.98% | 2.91% | 3.15% | 2.74% |

| 2018 | 3.06% | 2.66% | 3.25% | 2.47% |

| 2017 | 2.63% | 2.85% | 3.00% | 2.62% |

| 2016 | 2.89% | 2.85% | 3.22% | 2.54% |

| 2015 | 2.97% | 2.82% | 3.26% | 2.56% |

| 2014 | 2.63% | 2.58% | 2.79% | 2.45% |

SCHD Dividend Yield Analyst Report

This ETF offers exposure to dividend-paying U.S. Equities, making SCHD a potentially useful tool for either enhancing current returns derived from the equity portion of a portfolio or for scaling back risk exposure within a portfolio. While there are dozens of funds offering exposure to dividend-paying stocks, SCHD offers a somewhat unique approach to this strategy.

The underlying index methodology requires a long track record of distributions, meaning that this product is unlikely to include small, speculative firms that are offering an attractive distribution yield because their stock price has been depressed. The methodology also considers multiple metrics, including dividend growth and dividend yield, resulting in a portfolio that should offer a substantial upgrade in payout compared to the broader market.

SCHD Dividend Information

SCHD has a dividend yield of 3.39% and paid $2.66 per share in the past year. The dividend is paid every three months and the last ex-dividend date was Dec 6, 2023.

SCHD Dividend Highlights

- A straightforward, low-cost fund offering potential tax-efficiency

- The Fund can serve as part of the core or complement in a diversified portfolio

- Tracks an index focused on the quality and sustainability of dividends

- Invests in stocks selected for fundamental strength relative to their peers, based on financial ratios

SCHD Dividend History

Here is SCHD Dividend History Table

| Ex/EFF Date | Type | Cash Amount | Declaration Date | Record Date | Payment Date |

|---|---|---|---|---|---|

| 12/06/2023 | Cash | $0.7423 | 03/10/2023 | 12/07/2023 | 12/11/2023 |

| 09/20/2023 | Cash | $0.6545 | 03/10/2023 | 09/21/2023 | 09/25/2023 |

| 06/21/2023 | Cash | $0.6647 | 03/10/2023 | 06/22/2023 | 06/26/2023 |

| 03/22/2023 | Cash | $0.5965 | 03/10/2023 | 03/23/2023 | 03/27/2023 |

| 12/07/2022 | Cash | $0.7034 | 02/18/2022 | 12/08/2022 | 12/12/2022 |

| 09/21/2022 | Cash | $0.6367 | 02/18/2022 | 09/22/2022 | 09/26/2022 |

| 06/22/2022 | Cash | $0.7038 | 02/18/2022 | 06/23/2022 | 06/27/2022 |

| 03/23/2022 | Cash | $0.5176 | 02/18/2022 | 03/24/2022 | 03/28/2022 |

| 12/08/2021 | Cash | $0.6198 | 02/02/2021 | 12/09/2021 | 12/13/2021 |

| 09/22/2021 | Cash | $0.587 | 02/02/2021 | 09/23/2021 | 09/27/2021 |

| 06/23/2021 | Cash | $0.5396 | 02/02/2021 | 06/24/2021 | 06/28/2021 |

| 03/24/2021 | Cash | $0.5026 | 02/02/2021 | 03/25/2021 | 03/29/2021 |

| 12/10/2020 | Cash | $0.6015 | 01/23/2020 | 12/11/2020 | 12/15/2020 |

| 09/23/2020 | Cash | $0.543 | 01/23/2020 | 09/24/2020 | 09/28/2020 |

| 06/24/2020 | Cash | $0.442 | 01/23/2020 | 06/25/2020 | 06/29/2020 |

| 03/25/2020 | Cash | $0.4419 | 01/23/2020 | 03/26/2020 | 03/30/2020 |

| 12/12/2019 | Cash | $0.4658 | 01/29/2019 | 12/13/2019 | 12/17/2019 |

| 09/25/2019 | Cash | $0.4855 | 01/29/2019 | 09/26/2019 | 09/30/2019 |

| 06/26/2019 | Cash | $0.4209 | 01/29/2019 | 06/27/2019 | 07/01/2019 |

| 03/20/2019 | Cash | $0.352 | 01/29/2019 | 03/21/2019 | 03/25/2019 |

| 12/12/2018 | Cash | $0.4054 | 12/13/2018 | 12/13/2018 | 12/17/2018 |

| 09/25/2018 | Cash | $0.3668 | 01/31/2018 | 09/26/2018 | 09/28/2018 |

| 06/26/2018 | Cash | $0.4056 | 01/31/2018 | 06/27/2018 | 06/29/2018 |

| 03/16/2018 | Cash | $0.2615 | 03/15/2018 | 03/19/2018 | 03/22/2018 |

| 12/18/2017 | Cash | $0.3448 | 12/15/2017 | 12/19/2017 | 12/22/2017 |

| 09/18/2017 | Cash | $0.3439 | 09/15/2017 | 09/19/2017 | 09/22/2017 |

| 06/19/2017 | Cash | $0.3312 | 06/16/2017 | 06/21/2017 | 06/23/2017 |

| 03/20/2017 | Cash | $0.3258 | 03/17/2017 | 03/22/2017 | 03/24/2017 |

| 12/19/2016 | Cash | $0.3987 | 12/16/2016 | 12/21/2016 | 12/23/2016 |

| 09/19/2016 | Cash | $0.2438 | 09/16/2016 | 09/21/2016 | 09/23/2016 |

| 06/20/2016 | Cash | $0.3174 | 06/17/2016 | 06/22/2016 | 06/24/2016 |

| 03/21/2016 | Cash | $0.2981 | 03/18/2016 | 03/23/2016 | 03/28/2016 |

| 12/21/2015 | Cash | $0.2715 | 12/18/2015 | 12/23/2015 | 12/28/2015 |

| 09/21/2015 | Cash | $0.2989 | 09/18/2015 | 09/23/2015 | 09/25/2015 |

| 06/22/2015 | Cash | $0.3063 | 06/19/2015 | 06/24/2015 | 06/26/2015 |

| 03/23/2015 | Cash | $0.2699 | 03/20/2015 | 03/25/2015 | 03/27/2015 |

| 12/22/2014 | Cash | $0.2754 | 12/19/2014 | 12/24/2014 | 12/29/2014 |

| 09/22/2014 | Cash | $0.2544 | 09/19/2014 | 09/24/2014 | 09/26/2014 |

| 06/23/2014 | Cash | $0.2693 | 06/20/2014 | 06/25/2014 | 06/27/2014 |

| 03/24/2014 | Cash | $0.2478 | 03/21/2014 | 03/26/2014 | 03/28/2014 |

| 12/23/2013 | Cash | $0.2489 | 12/20/2013 | 12/26/2013 | 12/30/2013 |

| 09/23/2013 | Cash | $0.2306 | 09/20/2013 | 09/25/2013 | 09/27/2013 |

| 06/24/2013 | Cash | $0.225 | 06/21/2013 | 06/26/2013 | 06/28/2013 |

| 03/18/2013 | Cash | $0.1993 | 03/15/2013 | 03/20/2013 | 03/22/2013 |

| 12/24/2012 | Cash | $0.2581 | 12/21/2012 | 12/27/2012 | 12/31/2012 |

| 09/17/2012 | Cash | $0.2078 | 09/14/2012 | 09/19/2012 | 09/21/2012 |

| 06/18/2012 | Cash | $0.2062 | 06/15/2012 | 06/20/2012 | 06/22/2012 |

| 03/19/2012 | Cash | $0.1379 | 03/16/2012 | 03/21/2012 | 03/23/2012 |

| 12/19/2011 | Cash | $0.1217 | 12/16/2011 | 12/21/2011 | 12/23/2011 |

Watch SCHD Dividend Yield, History on YouTube

Frequently Asked Questions

Does SCHD pay dividends?

Yes, SCHD has paid a dividend within the past 12 months.

How much is SCHD’s dividend?

When is SCHD ex-dividend date?

When is SCHD dividend payment date?

What is the 10 year return on SCHD?

Which ETF pays highest dividend?

While there isn’t a single “best” ETF for dividends because it depends on your investment goals, here are some options for ETFs with high dividend yields:

Focus on High Yield: These ETFs prioritize high current dividend yields, but may come with increased risk and lower long-term growth potential. Examples include:

- SPYD (SPDR Portfolio S&P 500 High Dividend ETF): Tracks high-yielding stocks in the S&P 500 with a current yield around 4.74% (as of March 9, 2024).

- PEY (Invesco High Yield Equity Dividend Achievers ETF): Invests in 50 U.S. companies with a history of increasing dividends, with a current yield around 4.95% (as of March 9, 2024).

Consider a Balance: These ETFs offer a balance between dividend yield and other factors like total return or lower volatility. Examples include:

- SCHD (Schwab U.S. Dividend Equity ETF): Focuses on high-quality dividend-paying companies with a current yield around 3.40% (as of March 9, 2024).

- VYM (Vanguard High Dividend Yield ETF): Tracks high-yielding stocks in developed markets outside the U.S., with a current yield around 4.52% (as of March 9, 2024).

Important things to remember:

- High dividend yields don’t guarantee future performance. Companies can cut dividends if their finances weaken.

- Consider the expense ratio: This is the annual fee charged by the ETF, which can eat into your returns.

- Focus on your goals: Are you looking for current income or long-term growth? Choose an ETF that aligns with your investment strategy.

What is yield on SCHD?

The dividend yield of SCHD (Schwab U.S. Dividend Equity ETF) is currently around 3.40% (as of March 8, 2024). This means that, based on the annualized dividend payments over the past year, you could expect to receive approximately $3.40 for every $100 you invest in SCHD.

It’s important to remember that dividend yields can fluctuate over time. You can find the most up-to-date yield information for SCHD on various financial websites or directly from the issuer, Schwab Asset Management: Click Here

Does SCHD pay monthly?

What ETF has 12% yield?

There are very few ETFs with a sustainable dividend yield of 12%. While some high-yield ETFs may advertise yields that high, it’s important to consider a few things:

- Underlying holdings: These ETFs may invest in companies or sectors with higher risk profiles, which could lead to dividend cuts in the future.

- Use of options or leverage: Some ETFs might use options strategies or leverage to generate higher yields, which can be complex and come with additional risks.

Here are some ETFs with yields around 12%, but it’s important to do your own research on these and any other ETF before investing:

- Global X SuperDividend ETF (SDIV): Currently yields around 12.05%, but invests in high-dividend stocks from around the world, which can be more volatile.

- YYY (Amplify High Income ETF): Currently yields around 12.10%, but uses options strategies to achieve its high yield.

Alternatives to consider:

- Focus on quality and sustainability: Look for ETFs that invest in established companies with a history of paying consistent dividends. While the yield might be lower than 12%, it may be more sustainable in the long run.

- Consider a combination: You could create a portfolio that combines some high-yield ETFs with lower-yielding, but potentially more stable, dividend-paying ETFs or stocks.

Are SCHD dividends taxable?

Yes, SCHD dividends can be taxable, but the tax treatment depends on how long you’ve held the ETF and the type of dividend received. Here’s a breakdown:

Types of Dividends:

- Qualified Dividends: These are generally taxed at a lower capital gains rate compared to ordinary income tax rates. To qualify for the lower rate, you typically need to hold the ETF for at least one year (meeting the short-term holding period) before the ex-dividend date.

- Non-Qualified Dividends: These are taxed at your ordinary income tax rate. This could apply to a portion of SCHD’s dividends if the ETF sells underlying holdings recently or earns income from sources not considered qualified dividends.

Tax Implications:

- Short-Term Holding (Less than one year): Any dividends received, qualified or non-qualified, will be taxed at your ordinary income tax rate.

- Long-Term Holding (More than one year): Qualified dividends will be taxed at the capital gains rate, which can be lower than your ordinary income tax rate depending on your tax bracket. Non-qualified dividends will still be taxed at your ordinary income tax rate.

How often does schd pay out?

What is the best ETF with Charles Schwab?

Determining the “best” ETF with Charles Schwab depends on your individual investment goals and risk tolerance. However, I can provide some insights on highly-rated Charles Schwab ETFs across different categories:

High Dividend Yield:

- SCHD (Schwab U.S. Dividend Equity ETF): Tracks high-quality dividend-paying U.S. companies with a current yield around 3.40%. Good for income-oriented investors seeking stability.

Total Stock Market Exposure:

- SCHX (Schwab U.S. Large-Cap ETF): Tracks large-capitalization U.S. stocks, offering broad market exposure at a low cost (expense ratio of 0.03%). Good for long-term investors seeking overall market growth.

International Equity:

- SCHF (Schwab International Equity ETF): Tracks developed international markets outside the U.S., offering diversification and potential for international growth. Good for investors seeking exposure to global markets.

Specialty ETFs:

- SCHH (Schwab U.S. REIT ETF): Invests in U.S. real estate investment trusts (REITs), offering exposure to the real estate market through a liquid ETF structure. Good for investors seeking diversification and potential real estate income.

Remember:

- Consider your investment goals and risk tolerance before choosing an ETF.

- Past performance is not necessarily indicative of future results.

- Diversification is key – consider a portfolio with a mix of ETFs to spread your risk.

- You can always invest in a combination of the above-mentioned ETFs to create a well-rounded portfolio.

What is SCHD Dividend Per Share Price?

SCHD (Schwab U.S. Dividend Equity ETF) doesn’t provide the exact dividend per share price upfront because the dividend amount can fluctuate from quarter to quarter. However, there are a couple of ways to estimate the recent dividend per share:

Check the Distribution History: Some financial websites track historical dividend payouts for ETFs, including SCHD. This information might show you the specific amount paid per share in the most recent quarter.

Annual Dividend Yield and Current Share Price:

- Divide the annual dividend yield by 4 (assuming quarterly distributions). For example, if the current yield is 3.40%, then divide it by 4 to get an estimated quarterly yield of 0.85%.

- Divide the estimated quarterly yield (0.85%) by the current share price of SCHD around $78.27 as of March Month, 2024). This will give you an approximate dividend per share for the last quarter.