Ford Dividend History

This article provides detailed information on Ford dividend history, including:

- Dividend Amount: The amount of the dividend paid per share.

- Dividend Date: The date on which the dividend was paid.

- Ex-Dividend Date: The date on which the stock trades ex-dividend, meaning that buyers on or after this date will not receive the upcoming dividend.

- Dividend Yield: The annualized dividend per share divided by the stock price.

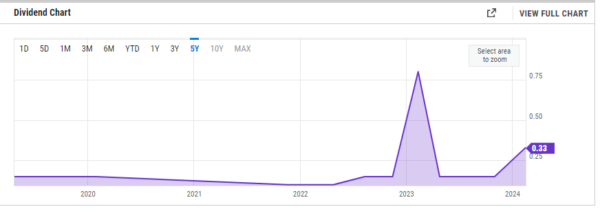

Ford Dividend History Chart

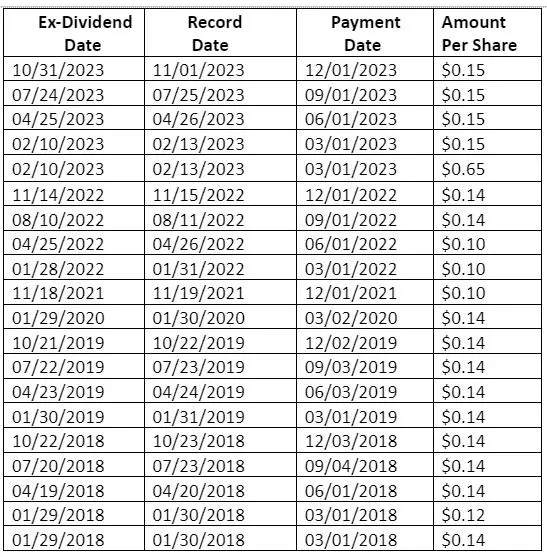

| Ex-Date | Record Date | Pay Date | Declared Date | Type | Amount |

|---|---|---|---|---|---|

| Feb 15, 2024 | Feb 16, 2024 | Mar 01, 2024 | Feb 06, 2024 | Normal | 0.15 |

| Feb 15, 2024 | Feb 16, 2024 | Mar 01, 2024 | Feb 06, 2024 | Special | 0.18 |

| Oct 31, 2023 | Nov 01, 2023 | Dec 01, 2023 | Oct 17, 2023 | Normal | 0.15 |

| Jul 24, 2023 | Jul 25, 2023 | Sep 01, 2023 | Jul 13, 2023 | Normal | 0.15 |

| Apr 25, 2023 | Apr 26, 2023 | Jun 01, 2023 | Apr 06, 2023 | Normal | 0.15 |

| Feb 10, 2023 | Feb 13, 2023 | Mar 01, 2023 | Feb 02, 2023 | Special | 0.65 |

| Feb 10, 2023 | Feb 13, 2023 | Mar 01, 2023 | Feb 02, 2023 | Normal | 0.15 |

| Nov 14, 2022 | Nov 15, 2022 | Dec 01, 2022 | Oct 26, 2022 | Normal | 0.15 |

| Aug 10, 2022 | Aug 11, 2022 | Sep 01, 2022 | Jul 28, 2022 | Normal | 0.15 |

| Apr 25, 2022 | Apr 26, 2022 | Jun 01, 2022 | Apr 07, 2022 | Normal | 0.10 |

| Jan 28, 2022 | Jan 31, 2022 | Mar 01, 2022 | Jan 10, 2022 | Normal | 0.10 |

| Nov 18, 2021 | Nov 19, 2021 | Dec 01, 2021 | Oct 27, 2021 | Normal | 0.10 |

| Jan 29, 2020 | Jan 30, 2020 | Mar 02, 2020 | Jan 08, 2020 | Normal | 0.15 |

| Oct 21, 2019 | Oct 22, 2019 | Dec 02, 2019 | Oct 10, 2019 | Normal | 0.15 |

| Jul 22, 2019 | Jul 23, 2019 | Sep 03, 2019 | Jul 11, 2019 | Normal | 0.15 |

| Apr 23, 2019 | Apr 24, 2019 | Jun 03, 2019 | Apr 08, 2019 | Normal | 0.15 |

| Jan 30, 2019 | Jan 31, 2019 | Mar 01, 2019 | Jan 16, 2019 | Normal | 0.15 |

| Oct 22, 2018 | Oct 23, 2018 | Dec 03, 2018 | Oct 11, 2018 | Normal | 0.15 |

| Jul 20, 2018 | Jul 23, 2018 | Sep 04, 2018 | Jul 12, 2018 | Normal | 0.15 |

| Apr 19, 2018 | Apr 20, 2018 | Jun 01, 2018 | Apr 10, 2018 | Normal | 0.15 |

| Jan 29, 2018 | Jan 30, 2018 | Mar 01, 2018 | Jan 17, 2018 | Special | 0.13 |

| Jan 29, 2018 | Jan 30, 2018 | Mar 01, 2018 | Jan 17, 2018 | Normal | 0.15 |

| Oct 20, 2017 | Oct 23, 2017 | Dec 01, 2017 | Oct 12, 2017 | Normal | 0.15 |

| Jul 20, 2017 | Jul 24, 2017 | Sep 01, 2017 | Jul 13, 2017 | Normal | 0.15 |

| Apr 18, 2017 | Apr 20, 2017 | Jun 01, 2017 | Apr 10, 2017 | Normal | 0.15 |

Watch Ford Dividend History on YouTube

Dividend Data

Ford Motor Company’s (F) dividend yield is 4.85%, which means that for every $100 invested in the company’s stock, investors would receive $4.85 in dividends per year.

Ford Motor Company’s payout ratio is 55.16%, which means that 55.16% of the company’s earnings are paid out as dividends. A low payout ratio may indicate that the company has a strong financial position and can invest in growth opportunities, while a high payout ratio may indicate that the company is returning most of its earnings to shareholders. F’s annual dividend is $0.60 per share. This is the total amount of dividends paid out to shareholders in a year.

Ford Motor Company’s (F) ex-dividend date is , which means that buyers purchasing shares on or after that date will not be eligible to receive the next dividend payment.

Ford Motor Company (F) pays dividends on a quarterly basis. Ford Motor Company (F) has increased its dividends for 3 consecutive years. This is a positive sign of the company’s financial stability and its ability to pay consistent dividends in the future.

Ford Dividend History Summary

The next Ford Motor Co. dividend is expected to go ex in 2 months and to be paid in 3 months.

The previous Ford Motor Co. dividend was 18c and it went ex 22 days ago and it was paid 7 days ago.

There are typically 4 dividends per year (excluding specials), and the dividend cover is approximately 7.8.

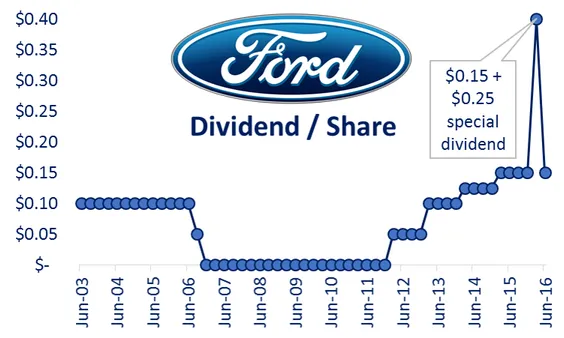

Dividend History and Growth

Ford Motor Company (F) dividend payments per share are an average of 20.00% over the past 12 months, 58.74% over the past 36 months, 0.00% over the past 60 months, and 4.14% over the past 120 months.

It is important to note that F’s dividend history and growth can be affected by many factors, such as profitability, cash flow, and financial stability, as well as its growth prospects and dividend payout policies. Add F to your watchlist to be aware of any updates.

Dividend Growth Table

Dividend Yield

F dividend yield graph is a visual representation of Ford Motor Company’s dividend yield over the last 12 months. This is useful for investors to understand F’s historical dividend yield and to identify any trends or patterns in the company’s dividend payments over time.

Shareholder Yield

Shareholder yield is a metric that measures the total return to shareholders through dividends, buybacks, and debt paydown. It is a ratio that compares the cash returned to shareholders over a period of time to the market capitalization of the company.

Ford Motor Company (F) shareholder yield graph below includes indicators for dividends, buybacks, and debt paydown, which allows investors to see how each component contributes to the overall shareholder yield.

It’s important to note that shareholder yield is just one metric among many that investors may use to evaluate a company’s financial health and its potential for future growth. It should be considered in conjunction with other financial metrics such as earnings, revenue, and debt levels to get a comprehensive understanding of a company’s financial position.

Dividend Safety

Dividend safety refers to the ability of a company to continue paying its dividends to shareholders without interruption or reduction. A company with a high level of dividend safety is generally considered to have a strong financial position, with a consistent history of paying dividends and a low risk of default.

Some specific indicators often used to assess Ford Motor Company (F) dividend safety include

- Dividend payment history: F has a history of paying dividends and has consistently increased its dividend payout for 3 consecutive years.

- Dividend payout ratio: A low payout ratio, typically less than 60%, indicates that a company has enough earnings to pay dividends and retain earnings to reinvest in the business. Ford Motor Company’s payout ratio is about 55.16%

It is worth noting that Dividend safety can change over time, and a company that was considered to have a high level of dividend safety in the past may no longer be considered safe today. Therefore, it is important to regularly monitor a company’s financial performance and dividend payment history.

Comparing Ford Motor Company to Other Stock

The percentile ranks table is a way to compare Ford Motor Company (F) dividend yield relative to its sector, country, and the world.

- Dividend yield: F’s latest value of 4.85% is the percentage of the current stock price that is paid out as dividends to shareholders. The relative to the sector, country, and world values (0.86, 0.76, and 0.79 respectively) indicate Ford Motor Company’s dividend yield compared to others in its sector, country, and world. For example, a value of 0.76 relative to country means that Ford Motor Company’s dividend yield is higher than 76% of companies in its country.

This table allows investors to quickly compare a company’s dividend metrics to its peers in the sector, country, and the world, and evaluate its relative stability and growth potential.

In an earnings release, Ford CFO John Lawler highlighted robust cash generation, with the company targeting payouts of 40% to 50% of free cash flow.

For the current first quarter, the automaker declared regular of 15 cents per share and a special dividend of 18 cents per share, payable March 1 to shareholders at the close of Feb. 16.

Results: Ford earnings of 29 cents per share, down 43% and marking the first decline in five quarters, were more than double the 12 cents that analysts were expecting. Revenue of $46 billion, up 4% vs. expectations for a decline.

Ford Blue, the company’s gas- and hybrid-vehicle business, delivered Q4 earnings before interest and taxes (EBIT) of $813 million.

Ford Model e, the all-electric vehicle unit, lost $1.57 billion during the quarter, “reflecting an extremely competitive pricing environment,” the earnings release said.

Ford Pro, the commercial vehicle unit, produced EBIT of $1.811 billion in the quarter.

The balance sheet showed about $29 billion in cash and $46 billion in liquidity at year end.

Outlook: The automaker late Tuesday guided full-year 2024 adjusted EBIT of $10 billion-$12 billion, with the midpoint of $11 billion well above FactSet consensus views for $9.650 billion. It also forecast free cash flow (FCF) of $6 billion-$7 billion.

Archrival GM on Jan. 30 provided bullish outlook as well.

Ford Stock Performance

Shares of Ford Motor surged 5.9% to 12.78 in early trade on the stock market today. F stock pared gains to 12.31 in morning trade.

Ford stock jumped above its 200-day moving average Wednesday, briefly clearing a short-term high of 12.50. It’s also flirting with a longer-term trendline. All of those could offer an early entry for risk-tolerant investors. The stock’s 50-day average is rising but remains below the 200-day line for now.

GM stock and STLA stock also rose. Stellantis reports for Q4 on Feb. 15.

Toyota stock spiked 7.8% Tuesday and extended gains Wednesday. Toyota Motor (TM) on Tuesday forecast a record $30.3 billion net profit for the fiscal year ending March, thanks to higher global sales of hybrid vehicles. The move put TM stock almost 14% above a 194.43 buy point after a breakout in January.

Tesla stock staged a modest rebound Tuesday and eased Wednesday, still near multi-month lows.

Hybrid EVs Rise, Battery EVs Slow

Legacy automakers continue to pare back their big bets on “pure” or battery electric vehicles (BEVs). They report growing demand for hybrid vehicles, while industrywide BEV sales growth has slowed.

Hybrid vehicles made up 13% of Ford Blue’s U.S. volume last year. Those included gas-electric versions of the flagship F-150 and smaller Maverick pickups. “We’re expecting double-digit hybrid growth again in 2024,” the Ford earnings release said Tuesday.

In January, Ford’s hybrid EV sales continued to power its overall new vehicle sales, continuing the momentum seen in the final quarter of 2023.

Amid record hybrid sales, Ford’s 2023 sales in the U.S. market totaled 1,995,912 vehicles — up 7% over 2022 and the best since 2020, capped by a slight Q4 gain despite the labor strike. Combustion vehicles still made up 90% of total 2023 sales.

While many customers are interested in buying BEVs, they are unwilling to pay premiums for them over gas or hybrid vehicles, industry watchers say. That has hurt BEV prices and profitability, Ford has said.

GM is now bringing back hybrid vehicles, hedging its earlier pursuit of all-electric vehicles.

DEARBORN, Mich., Oct. 16, 2023 – The board of directors of Ford Motor Company today declared a fourth-quarter regular dividend of 15 cents per share on the company’s outstanding common and Class B stock.

The dividend is payable on Dec. 1 to shareholders of record at the close of business on Nov. 1.

Dividend FAQ

Does Ford Motor Company pay dividends?

Ford Motor Company (F) pays dividends to its shareholders.

How much is Ford Motor Company’s dividend?

Ford Motor Company’s (F) quarterly dividend per share was $0.15 as of March 1, 2024.

When is Ford Motor Company’s ex-dividend date?

Ford Motor Company’s latest ex-dividend date was on February 15, 2024. The F stock shareholders received the last dividend payment of $0.15 per share on March 1, 2024.

When is Ford Motor Company’s next dividend payment date?

Ford Motor Company’s next dividend payment has not been announced at this time.

Does Ford Motor Company have sufficient earnings to cover its dividends?

Ford Motor Company (F) has a 55.16% payout ratio, which may leave the company with limited retained earnings, which could potentially impact its ability to reinvest in the business.

Ford Motor Company (NYSE: F) is a global company based in Dearborn, Michigan, committed to helping build a better world, where every person is free to move and pursue their dreams. The company’s Ford+ plan for growth and value creation combines existing strengths, new capabilities and always-on relationships with customers to enrich experiences for customers and deepen their loyalty.

Ford develops and delivers innovative, must-have Ford trucks, sport utility vehicles, commercial vans and cars and Lincoln luxury vehicles, along with connected services. The company does that through three customer-centered business segments: Ford Blue, engineering iconic gas-powered and hybrid vehicles; Ford Model e, inventing breakthrough EVs along with embedded software that defines exceptional digital experiences for all customers; and Ford Pro, helping commercial customers transform and expand their businesses with vehicles and services tailored to their needs.

Additionally, Ford provides financial services through Ford Motor Credit Company. Ford employs about 177,000 people worldwide. More information about the company and its products and services is available at corporate.ford.com.