IMPP Stock Price Today 2025

IMPP Stock Price Today, Forecast, Target Level Signals: IMPP stock represents ownership in Imperial Petroleum Inc., a Greece-based international shipping company specializing in the transportation of various petroleum and petrochemical products. Here’s a breakdown of key details about IMPP stock: We discuss about in this article IMPP Stock Price Today, Forecast, Target Level Signals and many more important things.

Company Details

- Industry – Water Transport/Shipping

- Sector – Transportation/Logistics

- Fiscal Year End – 12/2025

Imperial Petroleum, Inc. Operates as a ship-owning company. It provides petroleum product and crude oil seaborne transportation services. The firm offers international seaborne transportation services to oil producers, refineries and commodities traders. It has a fleet of three medium range product tankers that carry refined petroleum products such as gasoline, diesel, fuel oil and jet fuel, as well as edible oils and chemicals, and one Aframax tanker which is used for carrying crude oil. The company was founded on May 14, 2021 and is headquartered in Athens,

Greece.

Company: Imperial Petroleum Inc. Stock Symbol: IMPP Stock Exchange: NASDAQ

What They Do:

- Imperial Petroleum focuses on transporting liquid products like gasoline, diesel, fuel oil, and jet fuel via maritime routes.

- They also handle edible oils, chemicals, crude oil, iron ore, coal, grains, and other dry bulk cargo using specialized drybulk carriers.

Before Investing:

- Conduct your own research to understand Imperial Petroleum’s financial performance, past stock price movements, and industry trends.

- Consider the overall market conditions and potential risks involved in any stock investment.

Additional Resources:

- You can find more information about Imperial Petroleum on their investor relations page or financial news websites.

- Financial websites and investment tools can provide further details about IMPP stock price history, analysis, and potential future performance.

Imperial Petroleum stock downgraded to Buy Candidate

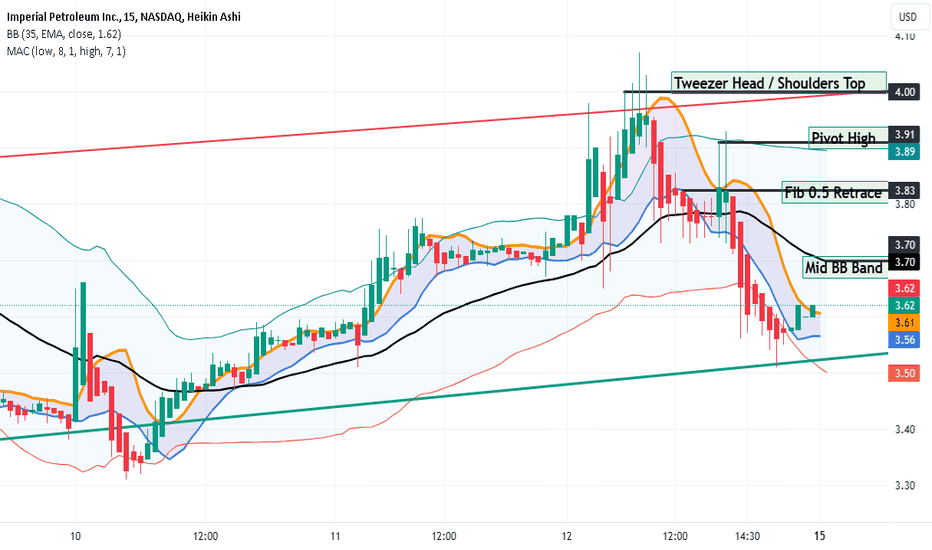

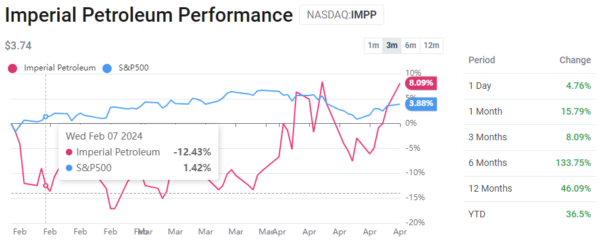

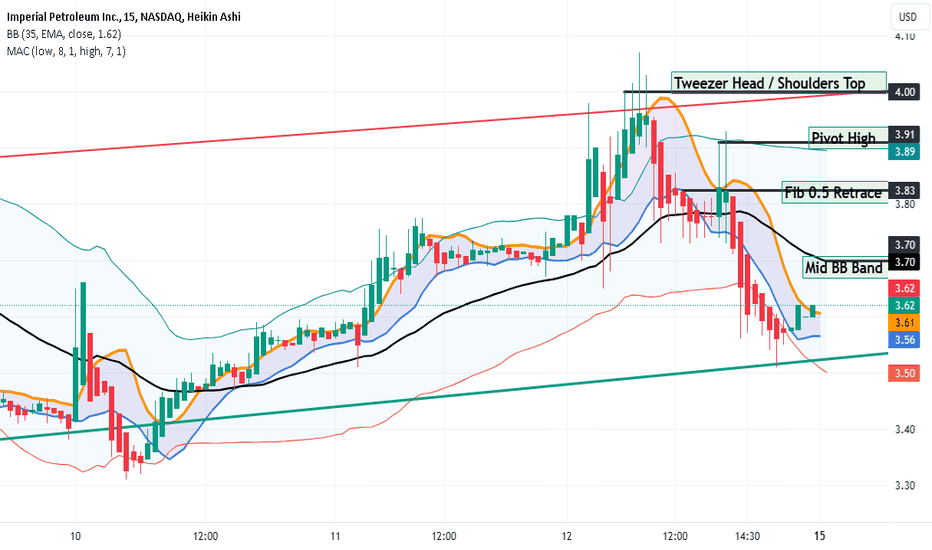

The Imperial Petroleum stock price gained 4.76% on the last trading day (Monday, 29th Apr 2024), rising from $3.57 to $3.74. It has now gained 5 days in a row. It will be exciting to see whether it manages to continue gaining or take a minor break for the next few days. During the last trading day the stock fluctuated 6.23% from a day low at $3.53 to a day high of $3.75.

The price has risen in 6 of the last 10 days and is up by 10.32% over the past 2 weeks. Volume has increased on the last day along with the price, which is a positive technical sign, and, in total, 143 thousand more shares were traded than the day before. In total, 421 thousand shares were bought and sold for approximately $1.57 million.

The stock lies in the upper part of a wide and strong rising trend in the short term, and this may normally pose a very good selling opportunity for the short-term trader as reaction back towards the lower part of the trend can be expected. A break-up at the top trend line at $3.83 will firstly indicate a stronger rate of rising. Given the current short-term trend, the stock is expected to rise 11.28% during the next 3 months and, with a 90% probability hold a price between $3.51 and $4.26 at the end of this 3-month period.

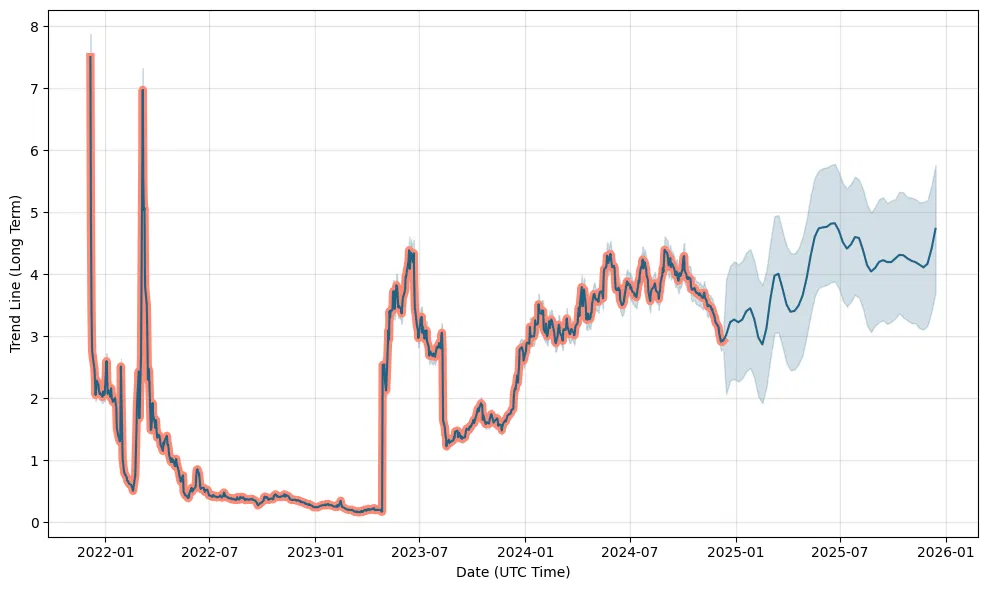

IMPP Signals & Forecast

The Imperial Petroleum stock holds buy signals from both short and long-term Moving Averages giving a positive forecast for the stock. Also, there is a general buy signal from the relation between the two signals where the short-term average is above the long-term average. On corrections down, there will be some support from the lines at $3.44 and $3.31. A breakdown below any of these levels will issue sell signals.

Support, Risk & Stop-loss for Imperial Petroleum stock

Imperial Petroleum finds support from accumulated volume at $3.63 and this level may hold a buying opportunity as an upwards reaction can be expected when the support is being tested.

This stock has average movements during the day and with good trading volume, the risk is considered to be medium. During the last day, the stock moved $0.220 between high and low, or 6.23%. For the last week, the stock has had daily average volatility of 5.23%.

Our recommended stop-loss: $3.60 (-3.84%) (This stock has medium daily movements and this gives medium risk. There is a sell signal from a pivot top found 12 days ago.)

Trading Expectations (IMPP) For The Upcoming Trading Day Of Tuesday 30th

For the upcoming trading day on Tuesday, 30th we expect Imperial Petroleum Inc. to open at $3.67, and during the day (based on 14 day Average True Range), to move between $3.53 and $3.95, which gives a possible trading interval of +/-$0.214 (+/-5.72%) up or down from last closing price. If Imperial Petroleum Inc. takes out the full calculated possible swing range there will be an estimated 11.44% move between the lowest and the highest trading price during the day.

Since the stock is closer to the resistance from accumulated volume at $3.75 (0.27%) than the support at $3.63 (2.94%), our systems don’t find the trading risk/reward intra-day attractive and any bets should be held until the stock is closer to the support level.

Trading Levels for IMPP

Is Imperial Petroleum Inc. Stock a Buy?

Several short-term signals, along with a general good trend, are positive and we conclude that the current level may hold a buying opportunity as there is a fair chance for Imperial Petroleum stock to perform well in the short-term. Due to some small weaknesses in the technical picture we have downgraded our analysis conclusion for this stock since the last evaluation from a Strong Buy to a Buy candidate.

What is Imperial Petroleum Inc. stock price today?

The current price of IMPP is 3.74 USD — it has increased by 4.76% in the past 24 hours.

What is Imperial Petroleum Inc. stock ticker?

Depending on the exchange, the stock ticker may vary. For instance, on NASDAQ exchange Imperial Petroleum Inc. stocks are traded under the ticker IMPP.

When is the next Imperial Petroleum Inc. earnings date?

Imperial Petroleum Inc. is going to release the next earnings report on Jun 11, 2024. Keep track of upcoming events with our Earnings Calendar.

How volatile is IMPP stock?

IMPP stock is 6.23% volatile and has beta coefficient of 1.33. Check out the list of the most volatile stocks — is Imperial Petroleum Inc. there?

Does Imperial Petroleum Inc. release reports?

Yes, you can track Imperial Petroleum Inc. financials in yearly and quarterly reports right on TradingView.

Is Imperial Petroleum Inc. stock price growing?

IMPP stock has risen by 12.65% compared to the previous week, the month change is a 21.82% rise, over the last year Imperial Petroleum Inc. has showed a 75.53% increase.

What is IMPP net income for the last quarter?

IMPP net income for the last quarter is 6.46 M USD, while the quarter before that showed 12.12 M USD of net income which accounts for −46.66% change. Track more Imperial Petroleum Inc. financial stats to get the full picture.

What is Imperial Petroleum Inc. EBITDA?

EBITDA measures a company’s operating performance, its growth signifies an improvement in the efficiency of a company. Imperial Petroleum Inc. EBITDA is 82.46 M USD, and current EBITDA margin is 44.88%. See more stats in Imperial Petroleum Inc. financial statements.

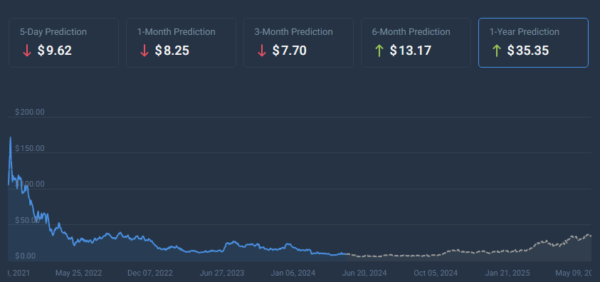

What is IMPP stock forecast?

We’ve gathered analysts’ opinions on Imperial Petroleum Inc. future price: according to them, IMPP price has a max estimate of 8.00 USD and a min estimate of 8.00 USD. Read a more detailed Imperial Petroleum Inc. forecast: see what analysts think of Imperial Petroleum Inc. and suggest that you do with its stocks.

Should I invest in Imperial Petroleum Inc. stock?

Investing in stocks requires a comprehensive research: you should carefully study all the available data, e.g. company’s financials, related news, and its technical analysis. So Imperial Petroleum Inc. technincal analysis shows the strong buy rating today, and its 1 week rating is buy.

Since market conditions are prone to changes, it’s worth looking a bit further into the future — according to the 1 month rating Imperial Petroleum Inc. stock shows the buy signal. See more of Imperial Petroleum Inc. technicals for a more comprehensive analysis.

If you’re still not sure, try looking for inspiration in our curated watchlists.

What are Imperial Petroleum Inc. stock highest and lowest prices ever?

IMPP reached its all-time high on Mar 8, 2022 with the price of 125.45 USD, and its all-time low was 1.18 USD and was reached on Aug 17, 2023. See other stocks reaching their highest and lowest prices.

How to buy Imperial Petroleum Inc. stocks?

Like other stocks, IMPP shares are traded on stock exchanges, e.g. Nasdaq, Nyse, Euronext, and the easiest way to buy them is through an online stock broker. To do this, you need to open an account and follow a broker’s procedures, then start trading. You can trade Imperial Petroleum Inc. stock right from TradingView charts — choose your broker and connect to your account.

Does Imperial Petroleum Inc. pay dividends?

No, IMPP doesn’t pay any dividends to its shareholders. But don’t worry, we’ve prepared a list of high-dividend stocks for you.

What is Imperial Petroleum Inc. market cap?

Today Imperial Petroleum Inc. has the market capitalization of 108.48 M, it has decreased by 2.11% over the last week.

What is the symbol for Imperial Petroleum Stock and on which exchange is it traded?

The symbol for Imperial Petroleum is IMPP and it is traded on the NASDAQ (NASDAQ Stock Exchange).

Should I buy or sell Imperial Petroleum Stock?

Several short-term signals, along with a general good trend, are positive and we conclude that the current level may hold a buying opportunity as there is a fair chance for Imperial Petroleum stock to perform well in the short-term. Due to some small weaknesses in the technical picture we have downgraded our analysis conclusion for this stock since the last evaluation from a Strong Buy to a Buy candidate.

How to buy Imperial Petroleum Stock?

Imperial Petroleum Stock can be purchased through just about any brokerage firm, including online brokerage services.

What’s the current price of Imperial Petroleum Stock?

As of the end of day on the Apr 29, 2024, the price of an Imperial Petroleum (IMPP) share was $3.74.

What is the 52-week high and low for Imperial Petroleum Stock?

The 52-week high for Imperial Petroleum Stock is $4.53 and the 52-week low is $1.18.

When is the next earnings date for Imperial Petroleum?

The upcoming earnings date for Imperial Petroleum is May 13, 2024.

What was Imperial Petroleum, Inc.’s price range in the past 12 months?

Imperial Petroleum, Inc. lowest stock price was $1.18 and its highest was $4.08 in the past 12 months.

What is Imperial Petroleum, Inc.’s market cap?

Imperial Petroleum, Inc.’s market cap is $103.55M.

When is Imperial Petroleum, Inc.’s upcoming earnings report date?

Imperial Petroleum, Inc.’s upcoming earnings report date is Jun 11, 2024 which is in 42 days.

How were Imperial Petroleum, Inc.’s earnings last quarter?

Imperial Petroleum, Inc. released its earnings results on Feb 13, 2024. The company reported -$0.02 earnings per share for the quarter, the consensus estimate of -$0.02 by $0.

Is Imperial Petroleum, Inc. overvalued?

According to Wall Street analysts Imperial Petroleum, Inc.’s price is currently Undervalued.

Does Imperial Petroleum, Inc. pay dividends?

Imperial Petroleum, Inc. pays a Notavailable dividend of $0.6 which represents an annual dividend yield of N/A. See more information on Imperial Petroleum, Inc.

What is Imperial Petroleum, Inc.’s EPS estimate?

Imperial Petroleum, Inc.’s EPS estimate is $0.23.

How many shares outstanding does Imperial Petroleum, Inc. have?

Imperial Petroleum, Inc. has 29,005,407 shares outstanding.

What happened to Imperial Petroleum, Inc.’s price movement after its last earnings report?

Imperial Petroleum, Inc. reported an EPS of -$0.02 in its last earnings report, expectations of -$0.02. Following the earnings report the stock price went down -3.681%.

Which hedge fund is a major shareholder of Imperial Petroleum, Inc.?

Among the largest hedge funds holding Imperial Petroleum, Inc.’s share is Towerview Llc. It holds Imperial Petroleum, Inc.’s shares valued at 1M.

Remember: Don’t solely rely on price predictions when making investment decisions. Conduct thorough research and understand your risk tolerance before investing in any stock.

Read our More Articles

- Chris Tucker Net Worth, Biography, Early Life

- Melissa McCarthy Net Worth, Salary, Early Life, Career

- Tobey Maguire Net Worth, Height, Age, Biography

- HCMC Stock Price Prediction 2025, 2030, 2035, 2040, 2045 and 2050

- ALGO Price Prediction 2025, 2026, 2027, 2028, 2030, 2040-2050