Healthier Choices Management Corp Stock (HCMC) Forecast

Company Developments and Financial Performance

HCMC’s journey through the financial year leading up to 2024 has been marked by noteworthy events and corporate actions. The company reported a significant increase in sales and gross margin in the third quarter of 2023, indicating robust operational performance. This growth was marked by a 120% year-over-year increase in sales, reaching $12.7 million, and a 149% increase in gross margin. Such financial results demonstrate HCMC’s potential in scaling its operations and improving profitability.

HCMC Stock Price Prediction, Long-term HCMC price forecast for 2025, 2030, 2035, 2040, 2045 and 2050

HCMC Stock Price Prediction – Based on our analysis about Healthier Choices Management Corp financial reports and earnings history, Healthier Choices Management Corp (HCMC) stock could reach $0.00113 by 2030, $0.00352 by 2040 and $0.00336 by 2050. See the projected annual prices until 2050 of the Healthier Choices Management Corp stock below:

- Healthier Choices Management Corp (HCMC) is expected to reach an average price of $0.0021 in 2035, with a high prediction of $0.00228 and a low estimate of $0.00215. This indicates an +2000.00% change from the last recorded price of $0.0001.

- Healthier Choices Management Corp (HCMC) stock is projected to chart a bullish course in 2040, with an average price target of $0.0032, representing an +3104.17% change from its current level. The forecast ranges from a conservative $0.0033 to a sky-high $0.00352.

- Our analysts predict Healthier Choices Management Corp (HCMC) to change +4395.83% by 2045, soaring from $0.0024 to an average price of $0.0045, potentially reaching $0.0047. While $0.0024 is the low estimate, the potential upside is significant.

- Healthier Choices Management Corp (HCMC) stock is expected to climb by 2050, reaching an average of $0.00317, a +3068.75% change from its current level. However, a wide range of estimates exists, with high and low targets of $0.00336 and $0.00297, respectively, highlighting the market’s uncertainty.

Healthier Choices Management Corp Stock (HCMC) Year by Year Forecast

Healthier Choices Management Corp Stock (HCMC) Price Forecast for 2024

| Month | Average | Low | High | Change from today’s price |

|---|---|---|---|---|

| June, 2024 | $0.000242 | $0.000242 | $0.000167 | +141.67% |

| July, 2024 | $0.000100 | $0.0002 | $0.000133 | +NaN% |

| August, 2024 | $0.000067 | $0.000167 | $0.000092 | -33.33% |

| September, 2024 | $0.000025 | $0.000125 | $0.000058 | -75.00% |

| October, 2024 | $0.00029 | $0.000108 | $0.0003 | +189.58% |

| November, 2024 | $0.000248 | $0.000348 | $0.000279 | +147.92% |

| December, 2024 | $0.000196 | $0.000296 | $0.000238 | +95.83% |

Healthier Choices Management Corp Stock (HCMC) Price Forecast for 2025

| Month | Average | Low | High | Change from today’s price |

|---|---|---|---|---|

| January, 2025 | $0.000204 | $0.000254 | $0.000185 | +104.17% |

| February, 2025 | $0.000213 | $0.000213 | $0.000144 | +112.50% |

| March, 2025 | $0.000131 | $0.00016 | $0.000102 | +31.25% |

| April, 2025 | $0.000363 | $0.000463 | $0.0004 | +262.50% |

| May, 2025 | $0.000413 | $0.000413 | $0.00035 | +312.50% |

| June, 2025 | $0.00025 | $0.00035 | $0.0003 | +150.00% |

| July, 2025 | $0.0002 | $0.0003 | $0.000238 | +100.00% |

| August, 2025 | $0.00025 | $0.00025 | $0.000188 | +150.00% |

| September, 2025 | $0.000485 | $0.000213 | $0.0005 | +385.42% |

| October, 2025 | $0.000427 | $0.000527 | $0.000471 | +327.08% |

| November, 2025 | $0.000469 | $0.000469 | $0.000413 | +368.75% |

| December, 2025 | $0.000346 | $0.000396 | $0.000354 | +245.83% |

Healthier Choices Management Corp Stock (HCMC) Price Forecast for 2026

| Month | Average | Low | High | Change from today’s price |

|---|---|---|---|---|

| January, 2026 | $0.000338 | $0.000338 | $0.000281 | +237.50% |

| February, 2026 | $0.000279 | $0.000279 | $0.000223 | +179.17% |

| March, 2026 | $0.00055 | $0.000265 | $0.0006 | +450.00% |

| April, 2026 | $0.000583 | $0.000583 | $0.000533 | +483.33% |

| May, 2026 | $0.000517 | $0.000517 | $0.000467 | +416.67% |

| June, 2026 | $0.000333 | $0.000433 | $0.0004 | +233.33% |

| July, 2026 | $0.000367 | $0.000367 | $0.000317 | +266.67% |

| August, 2026 | $0.000681 | $0.000317 | $0.0007 | +581.25% |

| September, 2026 | $0.000606 | $0.000706 | $0.000663 | +506.25% |

| October, 2026 | $0.000631 | $0.000631 | $0.000588 | +531.25% |

| November, 2026 | $0.000488 | $0.000538 | $0.000513 | +387.50% |

| December, 2026 | $0.000463 | $0.000463 | $0.000419 | +362.50% |

Healthier Choices Management Corp Stock (HCMC) Price Forecast for 2027

| Month | Average | Low | High | Change from today’s price |

|---|---|---|---|---|

| January, 2027 | $0.000388 | $0.000388 | $0.000344 | +287.50% |

| February, 2027 | $0.000758 | $0.000369 | $0.0008 | +658.33% |

| March, 2027 | $0.000754 | $0.000754 | $0.000738 | +654.17% |

| April, 2027 | $0.000671 | $0.000671 | $0.000633 | +570.83% |

| May, 2027 | $0.000467 | $0.000567 | $0.00055 | +366.67% |

| June, 2027 | $0.000483 | $0.000483 | $0.000446 | +383.33% |

| July, 2027 | $0.0009 | $0.000421 | $0.0009 | +800.00% |

| August, 2027 | $0.000785 | $0.000885 | $0.000877 | +685.42% |

| September, 2027 | $0.000794 | $0.000794 | $0.000763 | +693.75% |

| October, 2027 | $0.000602 | $0.000702 | $0.000671 | +502.08% |

| November, 2027 | $0.000588 | $0.000588 | $0.000579 | +487.50% |

| December, 2027 | $0.000496 | $0.000496 | $0.000465 | +395.83% |

Healthier Choices Management Corp Stock (HCMC) Price Forecast for 2028

| Month | Average | Low | High | Change from today’s price |

|---|---|---|---|---|

| January, 2028 | $0.000925 | $0.000473 | $0.001 | +825.00% |

| February, 2028 | $0.000925 | $0.000925 | $0.0009 | +825.00% |

| March, 2028 | $0.000825 | $0.000825 | $0.0008 | +725.00% |

| April, 2028 | $0.000675 | $0.000725 | $0.0007 | +575.00% |

| May, 2028 | $0.0006 | $0.0006 | $0.0006 | +500.00% |

| June, 2028 | $0.0011 | $0.000525 | $0.0011 | +1000.00% |

| July, 2028 | $0.000965 | $0.00106 | $0.00107 | +864.58% |

| August, 2028 | $0.000956 | $0.000956 | $0.000938 | +856.25% |

| September, 2028 | $0.000748 | $0.000848 | $0.000829 | +647.92% |

| October, 2028 | $0.000713 | $0.000713 | $0.000721 | +612.50% |

| November, 2028 | $0.000604 | $0.000604 | $0.000585 | +504.17% |

| December, 2028 | $0.00114 | $0.000577 | $0.0012 | +1041.67% |

Healthier Choices Management Corp Stock (HCMC) Price Forecast for 2029

| Month | Average | Low | High | Change from today’s price |

|---|---|---|---|---|

| January, 2029 | $0.0011 | $0.0011 | $0.00111 | +995.83% |

| February, 2029 | $0.000979 | $0.000979 | $0.000967 | +879.17% |

| March, 2029 | $0.000813 | $0.000863 | $0.00085 | +712.50% |

| April, 2029 | $0.000717 | $0.000717 | $0.000733 | +616.67% |

| May, 2029 | $0.0013 | $0.000629 | $0.0013 | +1200.00% |

| June, 2029 | $0.00118 | $0.00128 | $0.00127 | +1075.00% |

| July, 2029 | $0.00112 | $0.00112 | $0.00114 | +1018.75% |

| August, 2029 | $0.000894 | $0.000994 | $0.000988 | +793.75% |

| September, 2029 | $0.000869 | $0.000869 | $0.000863 | +768.75% |

| October, 2029 | $0.000713 | $0.000713 | $0.000738 | +612.50% |

| November, 2029 | $0.00133 | $0.000681 | $0.0014 | +1233.33% |

| December, 2029 | $0.00127 | $0.00127 | $0.0013 | +1166.67% |

Healthier Choices Management Corp Stock (HCMC) Price Forecast for 2030

| Month | Average | Low | High | Change from today’s price |

|---|---|---|---|---|

| January, 2030 | $0.00113 | $0.00113 | $0.00113 | +1033.33% |

| February, 2030 | $0.00095 | $0.001 | $0.001 | +850.00% |

| March, 2030 | $0.000867 | $0.000867 | $0.000867 | +766.67% |

| April, 2030 | $0.0015 | $0.000733 | $0.0015 | +1400.00% |

| May, 2030 | $0.00136 | $0.00146 | $0.00146 | +1258.33% |

| June, 2030 | $0.00127 | $0.00132 | $0.00132 | +1166.67% |

| July, 2030 | $0.00104 | $0.00114 | $0.00118 | +939.58% |

| August, 2030 | $0.000998 | $0.000998 | $0.001 | +897.92% |

| September, 2030 | $0.000821 | $0.000821 | $0.000863 | +720.83% |

| October, 2030 | $0.00153 | $0.000785 | $0.0016 | +1425.00% |

| November, 2030 | $0.00138 | $0.00148 | $0.00149 | +1275.00% |

| December, 2030 | $0.00129 | $0.00129 | $0.00134 | +1187.50% |

HCMC price prediction 2025

What predictions there are for 2025 expect the price to still be around $0.0002. Some forecasts had the price as high as $0.005 within five years, but they were made during the stock’s bull run in 2021 and a lot has changed since then.

HCMC price prediction 2030

There are no predictions that look at where HCMC’s price will be in a decade. The best hope for investors looking to hit the 2021 highs of $0.001 is that there are some share buybacks and a fundamental improvement in the business outlook.

HCMC Signals & Forecast

The Healthier Choices, Management stock holds buy signals from both short and long-term Moving Averages giving a positive forecast for the stock, but the stock has a general sell signal from the relation between the two signals where the long-term average is above the short-term average. For corrections down, there will be some support from the lines at $0.00002914 and $0.00004211. A breakdown below any of these levels will issue sell signals. Furthermore, there is a buy signal from the 3 month Moving Average Convergence Divergence (MACD).

Some negative signals were issued as well, and these may have some influence on the near short-term development. A sell signal was issued from a pivot top point on Friday, May 03, 2024, and so far it has fallen -50.00%. Further fall is indicated until a new bottom pivot has been found. Volume fell during the last trading day while the price increased. This causes a divergence and may be considered as an early warning, but it may not be. The very low volume increases the risk and reduces the other technical signals issued.

Watch HCMC Stock Price Prediction

What recent developments and acquisitions have HCMC made, and how might they affect the company’s future?

HCMC recently acquired Ellwood Thompson’s, an organic and natural health food store, as part of its strategy to diversify its product offerings and expand its market presence. This acquisition aligns with the growing demand for healthier lifestyle choices.

What is the stock forecast for HCMC in 2024, and what are some potential scenarios investors should be aware of?

The stock forecast for HCMC in 2024 is subject to various scenarios. If the company continues to deliver strong financial results, successfully integrates Ellwood Thompson’s, and resolves legal challenges favorably, it may experience steady stock price growth. However, external factors such as regulatory changes, competition, and market dynamics can introduce volatility. Monitoring HCMC’s financial reports, legal outcomes, and market trends will be essential for informed investment decisions in 2024.

About Healthier Choices Management Stock (OTCMKTS:HCMC)

Conclusion

In conclusion, our comprehensive analysis of Healthier Choices Management Corp. (HCMC) paints a picture of a company at a crucial juncture in its journey through 2024. From examining its stable stock price, strong financial performance, and strategic acquisitions to delving into the legal challenges it faces and the external factors influencing its stock price, we find a dynamic landscape. The stock forecast for 2024 is marked by promise and uncertainties, making it imperative for investors to stay vigilant, monitor developments, and make informed decisions in this ever-evolving market.

FAQ

What is HCMC’s current stock price and how has it been performing recently?

As early 2024, Healthier Choices Management Corp. (HCMC) is trading at a stable stock price of 0.0000 USD. This stability indicates a period of low volatility but also minimal short-term growth. The stock has maintained this consistent value recently.

What are some key factors influencing HCMC’s stock price in 2024?

Several factors can impact HCMC’s stock price in 2024. These include government policies related to vaping, technological advancements in the industry, competition, global supply chain dynamics, economic trends, and the outcome of the patent infringement lawsuit against R.J. Reynolds Vapor Company. All these external factors play a role in shaping the company’s stock performance.

Is Healthier Choices Management Corp stock A Buy?

Healthier Choices Management holds several positive signals, but we still don’t find these to be enough for a buy candidate. At the current level, it should be considered as a hold candidate (hold or accumulate) in this position whilst awaiting further development. We have upgraded our analysis conclusion for this stock since the last evaluation from a Strong Sell to a Hold/Accumulate candidate.

How high can HCMC stock stock?

According to WalletInvestor, HCMC will reach $0.0016 a year from now and $0.0051 in five years. These target prices suggest a 100 percent and 538 percent upside to the stock’s current price, respectively. How high can HCMC stock go? HCMC shares will rebound depending on the result of the Philip Morris case.

Is healthier choices management (HCMC) a good stock to buy?

Investors in Healthier Choices Management (HCMC) are seeing impressive gains in 2021. The stock has gained 700 percent this year despite trading 88 percent below the 52-week high of $0.0065 it hit in February 2021.

Will HCMC reach $0.0016 in 5 years?

According to WalletInvestor, HCMC will reach $0.0016 a year from now and $0.0051 in five years. These target prices suggest a 100 percent and 538 percent upside to the stock’s current price, respectively.

What is stock price prediction?

Stock Price Prediction. Stock Price Prediction using machine learning helps you discover the future value of company stock and other financial assets traded on an exchange. The entire idea of predicting stock prices is to gain significant profits. Predicting how the stock market will perform is a hard task to do.

How high can HCMC stock stock?

According to WalletInvestor, HCMC will reach $0.0016 a year from now and $0.0051 in five years. These target prices suggest a 100 percent and 538 percent upside to the stock’s current price, respectively. How high can HCMC stock go? HCMC shares will rebound depending on the result of the Philip Morris case.

Will HCMC reach $0.0016 in 5 years?

According to WalletInvestor, HCMC will reach $0.0016 a year from now and $0.0051 in five years. These target prices suggest a 100 percent and 538 percent upside to the stock’s current price, respectively.

Will Apple remain in the top 10 largest stocks by 2030?

Perhaps the least-surprising prediction is that the largest publicly traded company in the U.S., Apple ( AAPL -1.36%), will remain in the top 10 largest stocks by market cap by 2030. Aside from an easily recognized brand name and faithful customer base, Apple’s innovation is key to its success.

Will HCMC stock rebound after the Philip Morris case?

HCMC shares will rebound depending on the result of the Philip Morris case. A settlement or a licensing deal could push HCMC stock higher with no limit to how high it could go. HCMC stock is a good buy.

What was Healthier Choices Management Corp’s price range in the past 12 months?

What is Healthier Choices Management Corp’s market cap?

When is Healthier Choices Management Corp’s upcoming earnings report date?

How were Healthier Choices Management Corp’s earnings last quarter?

Is Healthier Choices Management Corp overvalued?

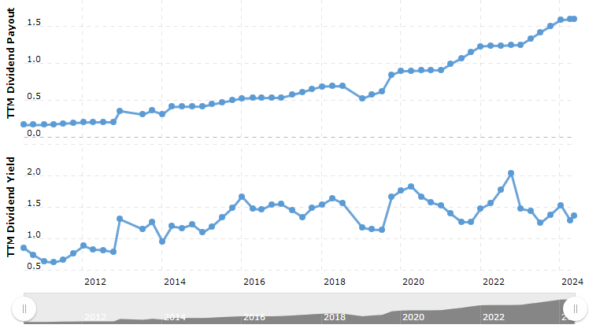

Does Healthier Choices Management Corp pay dividends?

What is Healthier Choices Management Corp’s EPS estimate?

How many shares outstanding does Healthier Choices Management Corp have?

What happened to Healthier Choices Management Corp’s price movement after its last earnings report?

Which hedge fund is a major shareholder of Healthier Choices Management Corp?

What are HCMC’s main business segments?

Grocery stores, gyms, nutritional supplements, and vape businesses dominate HCMC’s industry.

Is HCMC a publicly traded company?

HCMC is an OTC Markets listed corporation.

What are the risks associated with investing in penny stocks like HCMC?

Penny stocks like HCMC have minimal liquidity, significant volatility, and manipulation concerns. These risks may cause considerable financial losses.

How does HCMC plan to grow its business?

HCMC’s growth strategies include health and wellness collaborations, acquisitions, and organic expansion.

What is HCMC’s market capitalization?

In March 2023, HCMC’s market valuation was $149.5 million.

Read our More Articles

- ALGO Price Prediction 2024, 2025, 2026, 2027, 2028, 2030, 2040-2050

- Arbitrum ARB Price Prediction 2024, 2025, 2026, 2027, 2030, 2040 – 2050

- Muln Stock Price Prediction Tomorrow, Next week, 2024, 2025, 2030, 2035, 2040, 2050

- Rivian Stock Price Prediction 2025

- Muln Stock Price Prediction Tomorrow, Next week, 2024, 2025, 2030, 2035, 2040, 2050