VOO Dividend Yield Vanguard S&P 500 ETF

VOO Dividend Yield

| Dividend Yield | 1.35% | Annual Dividends | $6.36 |

|---|---|---|---|

| Price | 470.39 | Payments per Year | 4 |

| Declaration Date | 2023-12-18 | Ex-Dividend Date | 2023-12-20 |

| Record Date | 2023-12-21 | Payment Date | 2023-12-26 |

Dividend Summary

VOO Dividend Yield – The next Vanguard S&P 500 ETF dividend is expected to go ex in 13 days and to be paid in 18 days.

The previous Vanguard S&P 500 ETF dividend was 180.11c and it went ex 3 months ago and was paid 2 months ago.

There are typically 4 dividends per year (excluding specials), and the dividend cover is approximately 1.0.

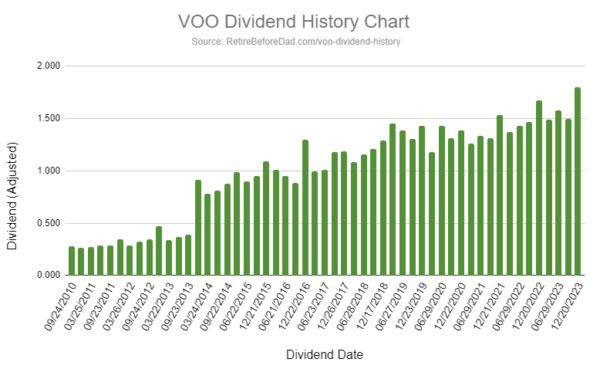

VOO Dividend History Chart

Ex-Dividend Date | Dividend | Payment Date | Yield |

|---|---|---|---|

| Dec 20, 2023 | 1.8 | Dec 26, 2023 | 1.64% |

| Sep 28, 2023 | 1.49 | Oct 03, 2023 | 1.52% |

| Jun 29, 2023 | 1.58 | Jul 05, 2023 | 1.57% |

| Mar 24, 2023 | 1.49 | Mar 29, 2023 | 1.64% |

| Dec 20, 2022 | 1.67 | Dec 23, 2022 | 1.91% |

| Sep 28, 2022 | 1.47 | Oct 03, 2022 | 1.75% |

| Jun 29, 2022 | 1.43 | Jul 05, 2022 | 1.63% |

| Mar 24, 2022 | 1.37 | Mar 29, 2022 | 1.34% |

| Dec 21, 2021 | 1.53 | Dec 27, 2021 | 1.46% |

| Sep 29, 2021 | 1.31 | Oct 04, 2021 | 1.31% |

| Jun 29, 2021 | 1.33 | Jul 02, 2021 | 1.35% |

| Mar 26, 2021 | 1.26 | Mar 31, 2021 | 1.41% |

| Dec 22, 2020 | 1.38 | Dec 28, 2020 | 1.63% |

| Sep 29, 2020 | 1.31 | Oct 02, 2020 | 1.7% |

| Jun 29, 2020 | 1.43 | Jul 02, 2020 | 2.07% |

| Mar 10, 2020 | 1.18 | Mar 13, 2020 | 1.87% |

| Dec 23, 2019 | 1.43 | Dec 27, 2019 | 1.93% |

| Sep 26, 2019 | 1.3 | Oct 01, 2019 | 1.9% |

| Jun 27, 2019 | 1.39 | Jul 02, 2019 | 2.07% |

| Mar 21, 2019 | 1.46 | Mar 26, 2019 | 2.24% |

| Dec 17, 2018 | 1.29 | Dec 20, 2018 | 2.15% |

| Sep 26, 2018 | 1.21 | Oct 01, 2018 | 1.8% |

| Jun 28, 2018 | 1.16 | Jul 03, 2018 | 1.86% |

| Mar 26, 2018 | 1.08 | Mar 29, 2018 | 1.82% |

| Dec 26, 2017 | 1.18 | Dec 29, 2017 | 1.92% |

| Sep 20, 2017 | 1.18 | Sep 25, 2017 | 2.04% |

| Jun 23, 2017 | 1.01 | Jun 29, 2017 | 1.87% |

| Mar 22, 2017 | 1 | Mar 28, 2017 | 1.85% |

| Dec 22, 2016 | 1.3 | Dec 29, 2016 | 2.49% |

| Sep 13, 2016 | 0.88 | Sep 19, 2016 | 1.78% |

| Jun 21, 2016 | 0.95 | Jun 27, 2016 | 1.99% |

| Mar 21, 2016 | 1.01 | Mar 28, 2016 | 2.14% |

| Dec 21, 2015 | 1.09 | Dec 28, 2015 | 2.37% |

| Sep 21, 2015 | 0.95 | Sep 25, 2015 | 2.12% |

| Jun 22, 2015 | 0.9 | Jun 26, 2015 | 1.86% |

| Mar 23, 2015 | 0.98 | Mar 27, 2015 | 2.03% |

| Dec 18, 2014 | 1.03 | Dec 24, 2014 | 1.88% |

| Sep 22, 2014 | 0.88 | Sep 26, 2014 | 1.83% |

| Jun 23, 2014 | 0.81 | Jun 27, 2014 | 1.6% |

| Mar 24, 2014 | 0.78 | Mar 28, 2014 | 1.43% |

| Dec 24, 2013 | 0.91 | Dec 31, 2013 | 1.19% |

| Sep 23, 2013 | 0.39 | Sep 27, 2013 | 1% |

| Jun 24, 2013 | 0.37 | Jun 28, 2013 | 1.04% |

| Mar 22, 2013 | 0.34 | Mar 28, 2013 | 1.03% |

| Dec 24, 2012 | 0.47 | Dec 31, 2012 | 1.08% |

| Sep 24, 2012 | 0.34 | Sep 28, 2012 | 0.96% |

| Jun 25, 2012 | 0.32 | Jun 29, 2012 | 1.01% |

| Mar 26, 2012 | 0.29 | Mar 30, 2012 | 0.94% |

| Dec 23, 2011 | 0.34 | Dec 30, 2011 | 1.03% |

| Sep 23, 2011 | 0.29 | Sep 29, 2011 | 1.07% |

| Jun 24, 2011 | 0.29 | Jun 30, 2011 | 0.93% |

| Mar 25, 2011 | 0.27 | Mar 31, 2011 | 0.67% |

| Dec 27, 2010 | 0.26 | Dec 31, 2010 | 0.47% |

| Sep 24, 2010 | 0.28 | Sep 30, 2010 | 0.27% |

VOO Dividend Information

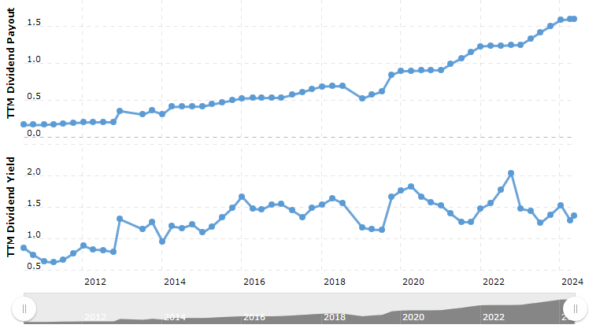

VOO has a dividend yield of 1.35% and paid $6.36 per share in the past year. The dividend is paid every three months and the last ex-dividend date was Dec 20, 2023. Vanguard S&P 500 ETF’s next ex-dividend date is projected to be between 22-Mar – 25-Mar. The next dividend for VOO is projected to be between 1.2625 – 1.4874.

About VOO’s dividend:

- Number of times Vanguard S&P 500 ETF has decreased the dividend in the last 3 years: 5

- The 1 year dividend growth rate for VOO is: 6.9%

- The number of times stock has increased the dividend in the last 3 years: 7

- The trailing 12 month dividend yield for VOO is: 1.4%

VOO Dividend Growth

Vanguard 500 Index Fund – 5 year dividend growth rate

VOO Dividend Forecast

| Year | Dividend | Estimated Yield on Cost |

|---|---|---|

| 2034 | 7.156USD * | 1.52% |

| 2033 | 7.079USD * | 1.50% |

| 2032 | 7.003USD * | 1.49% |

| 2031 | 6.929USD * | 1.47% |

| 2030 | 6.854USD * | 1.46% |

| 2029 | 6.781USD * | 1.44% |

| 2028 | 6.708USD * | 1.43% |

| 2027 | 6.637USD * | 1.41% |

| 2026 | 6.566USD * | 1.40% |

| 2025 | 6.495USD * | 1.38% |

| 2024 | 6.426USD * | 1.37% |

About VOO

Price: 470.56USD

Dividend Yield:1.30%

Forward Dividend Yield:1.53%

Payout Ratio:39.25%

Dividend Per Share:7.20 USD

Earnings Per Share:18.36 USD

P/E Ratio:25.08

Exchange:PCX

Volume:3.0 million

Market Capitalization:1.0 trillion

Average Dividend Frequency:4

Years Paying Dividends:14

DGR3:1.70%

DGR5:1.08%

DGR10:0.96%

Read our More Articles

- SCHD Dividend Yield, History, Growth Rate, Per Share and Date

- ARR Dividend History, Yield, Date, Growth and Forecast

- MPW Dividend History: Payouts, Trends, and Growth Insights for Investors.

- Jepi Dividend History Dates & Yield Complete Details